In 2018, the financial services industry is undergoing monumental regulatory reform.

European regulations, including the revised payments services directive (PSD2) and the UK’s open-banking mandates, are helping to drive these changes. Both were implemented by regulators to foster new competition in the market by lowering barriers for new entrants and creating equal access to proprietary customer data.

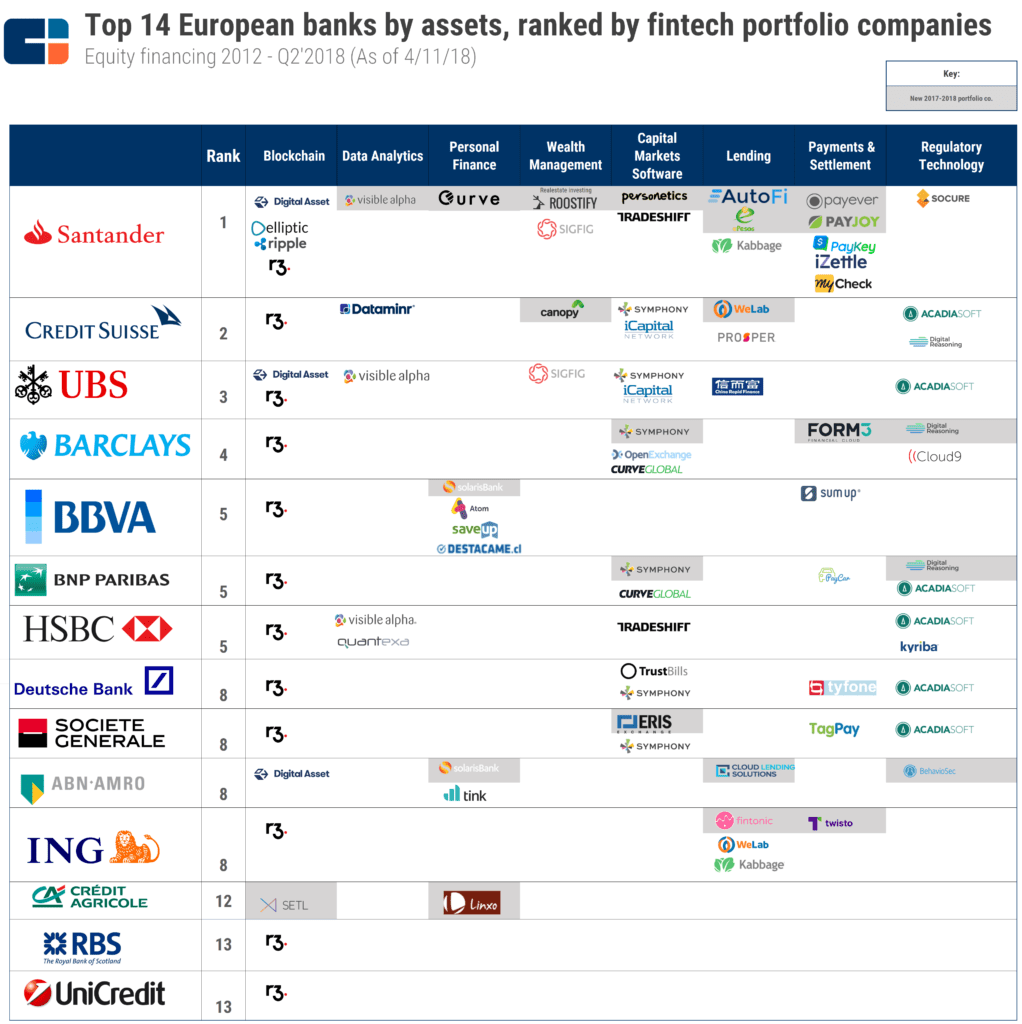

To stay relevant with customers and ahead of regulations, major banks in Europe have been implementing a number of strategies, including investing in the fintech startups the regulations enable.

Spain-based Banco Santander (and its venture arm Santander InnoVentures) continues to lead as the most active Europe-based banks participating in fintech investments. In the last 5-quarters, Banco Santander added 8 new fintech investments to the bank’s portfolio, the most of any other major European bank. Major European-based banks have also participated in investments to unicorn fintech companies including Prosper Marketplace, Kabbage, and Symphony Communication Services Holdings.

With a full roster of pending regulations, including the General Data Protection Regulation (GDPR) and the second Markets in Financial Instruments Directive (MiFID II), we anticipate banks will look for further opportunities to partner with and invest in fintech.

We used the CB Insights database to analyze the private market fintech investment activity of the top European banks, by assets under management, from 2012 to Q2’18 (as of 4/11/18). Banks’ venture arms are included in the analysis.

Note: France-based BPCE, Credit Mutuel Group, and UK-based Lloyds Banking Group have not made any equity investments to fintech startups during this period and are not pictured below.

Please click to enlarge.

Key Takeaways

- Ranked by the number of unique portfolio companies, the cohort’s most active investors are Banco Santander, Credit Suisse, and UBS — in that order.

- Banco Santander leads, with the most number of unique investments to fintech startups primarily through its venture arm Santander InnoVentures. The firm has made 23 equity investments to 19 unique fintech startups. The largest investment it participated in was a $135M Series E investment in Q3’15 to small business lender Kabbage, which also included participation from ING, among other investors.

- WeLab raised the largest investment that included this cohort, a $220M Series B-II in Q4’17 that included participation from Credit Suisse. ING is also an investor in WeLab and participated in its $160M Series B investment in Q1’16.

- The company with the most co-investments in this cohort is R3. R3 is a startup founded by a consortium of financial services firms and is developing use cases for blockchain applications. The company raised a $107M round of financing in Q2’17 that included participation from HSBC, Credit Suisse, BBVA, Societe Generale, ING, Deutsche Bank, Royal Bank of Scotland, UBS, BNP Paribas, and Barclays Bank, among others.

TRACK ALL THE FINTECH COMPANIES IN THIS BRIEF AND MANY MORE ON OUR PLATFORM

Fintech companies are disrupting all parts of the capital markets value chain. Look for Capital Markets Tech in the Collections tab.

Track Capital Markets Tech Startups- In the last 5 quarters, this cohort has been pulling back on blockchain investments. Credit Agricole made the only new blockchain investment, an undisclosed investment to SETL. Further, this cohort only made 1 follow-on investment, the R3 investment mentioned above.

- Instead of blockchain, this cohort is shifting its investment focus to capital markets technology. Communications and collaboration platform Symphony Communication Services Holdings, or Symphony, has seen the most investment participation from this cohort in the capital markets technology space. Symphony, already a unicorn ($1B+ valuation), raised a $67M Series D in Q2’18 that included Barclays. This was Barclay’s first investment to Symphony.