REPORT HIGHLIGHTS:

US TRENDS

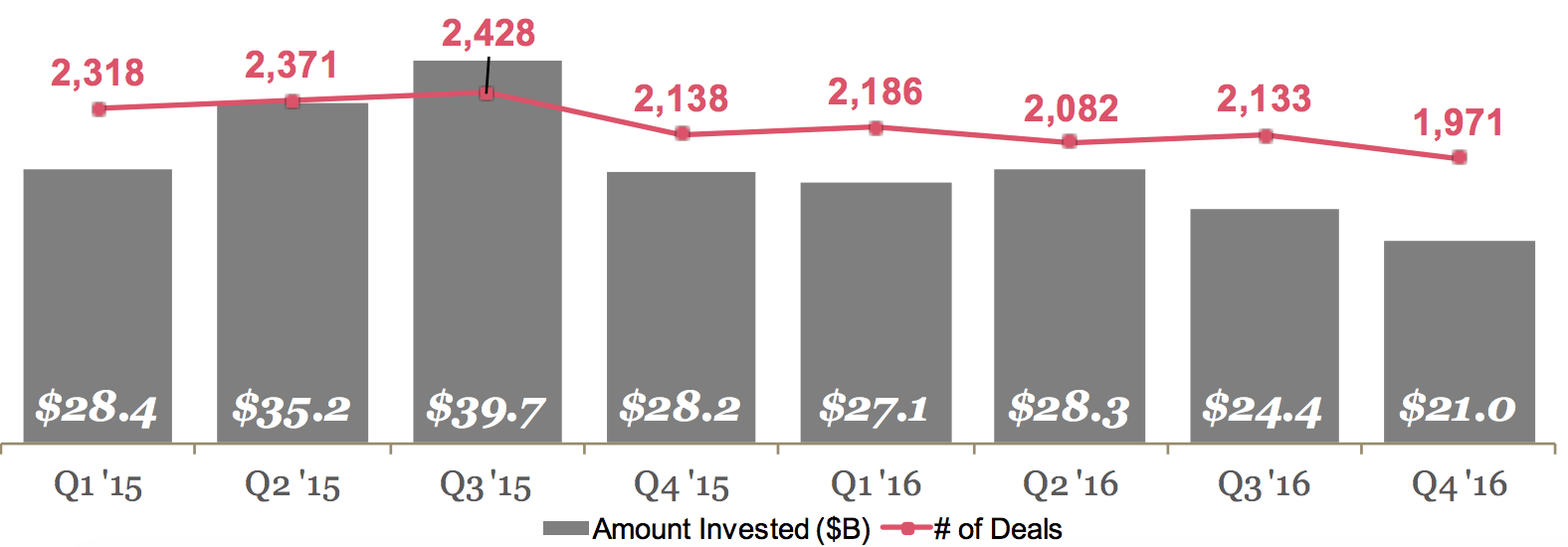

Deals continue fall, hitting 5-year quarterly low

Broad-based decline in deals across major tech hubs in CA and NY; DC/Metroplex emerged as one of the brighter spots

Internet holds top sector spot, Mobile & Telecom bumps Healthcare for second

Artificial Intelligence companies beat overall slowdown

Mega-round activity and unicorn birth rate remain low

US SECTORS

Internet was the top US sector in four of the past five quarters

Q4’16 was led by Internet, Healthcare, Mobile, Software, and Hardware

Within Internet, hot spaces were Analytics; Ad, Sales & Marketing; and Marketplaces

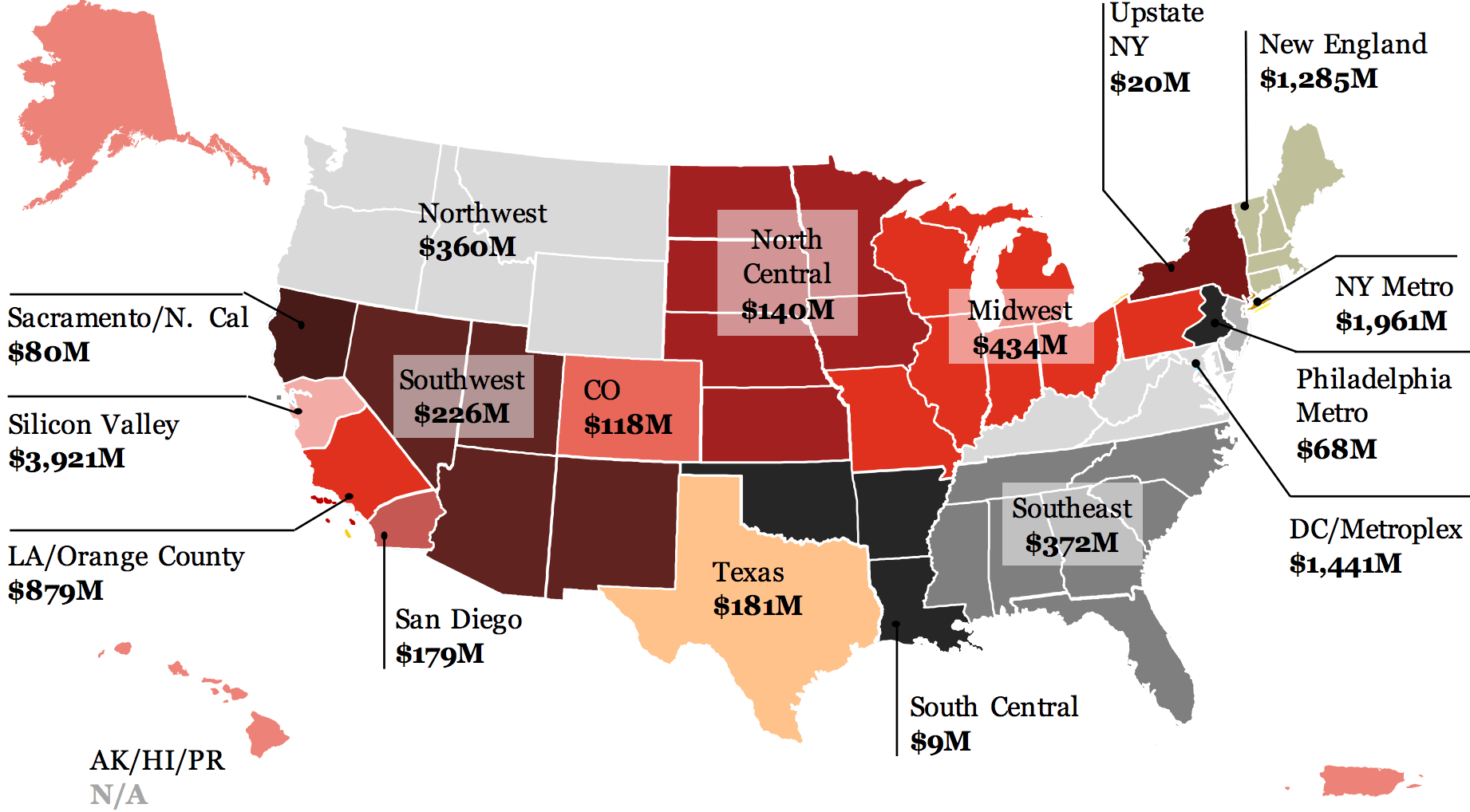

US PLACES

Top five regions in the USA for venture capital: Silicon Valley, NY, DC, New England, and LA/Orange County.

The top 10 US states for venture were led by California, New York, and Virginia.

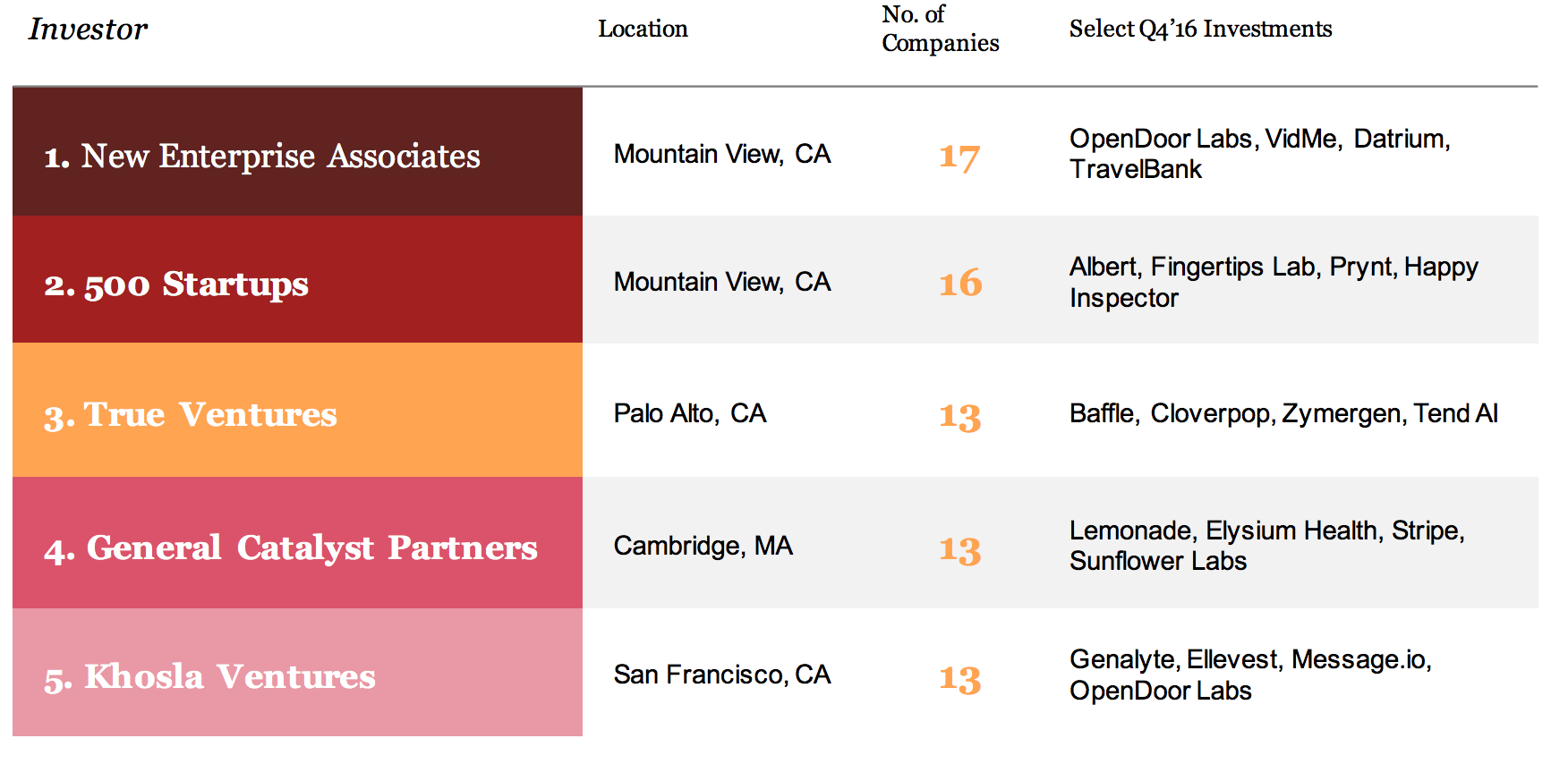

US MOVERS AND SHAKERS

The top 5 deals in the US in the quarter went to companies based in New York, Boston, San Francisco, and Arlington, VA.

The three most active venture capitalists in the quarter were NEA, 500 Startups, and True Ventures.

GLOBAL

Global deals dropped 16% on a full-year basis versus 2015.

North America saw funding into the region drop below $13B for the first time since Q’14, but Canada was a bright spot.

Funding jumped 22% in Europe and deals rose.

Asia saw deals and dollars plunge.

If you aren’t already a client, sign up for a free trial to learn more about our platform.