REPORT HIGHLIGHTS:

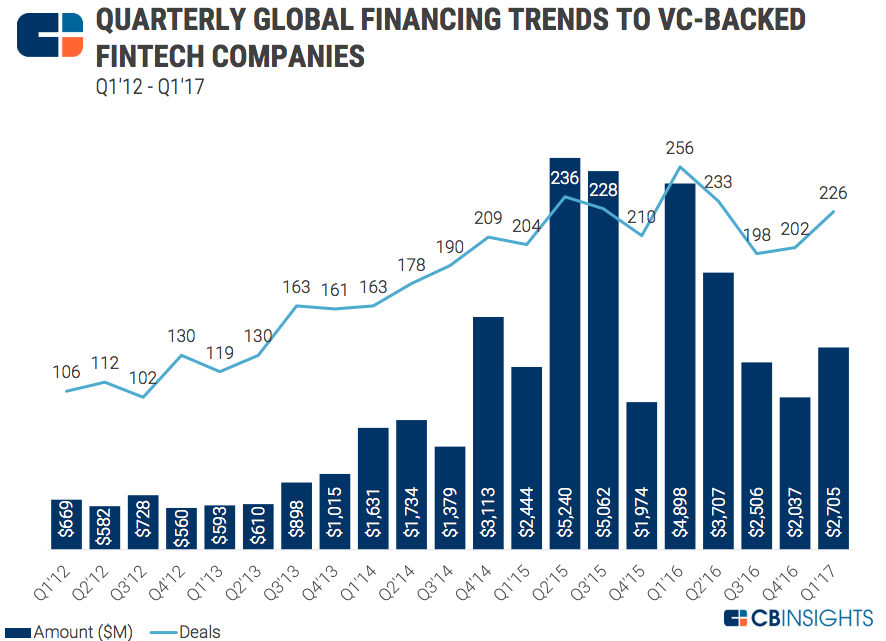

VC-BACKED FINTECH COMPANIES RAISE $2.7B ACROSS 226 DEALS IN Q1’17

Investment dollars to VC-backed fintech companies in 2017 is on pace to drop 18% from 2016, at the current run rate.Global fintech deal activity could surpass 2016’s all-time high if the rest of the year sustains Q1’17’s deal pace.

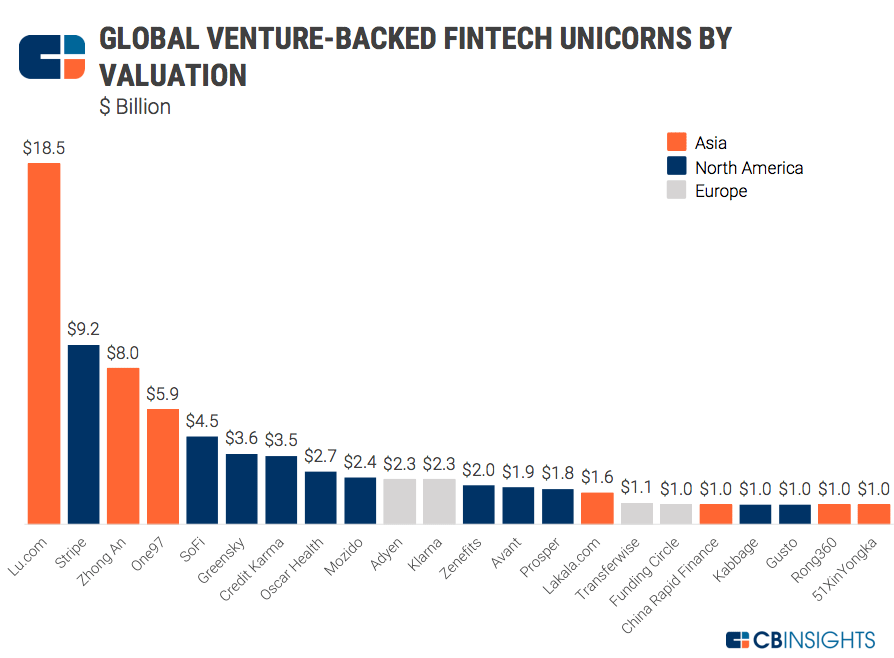

22 FINTECH UNICORNS GLOBALLY VALUED AT $77B

Q1’17 saw the second most highly valued fintech unicorn in the US, SoFi, raise $500M at a $4.5B valuation. China Rapid Finance, valued at $1B, filed for IPO on the last day of Q1’17.

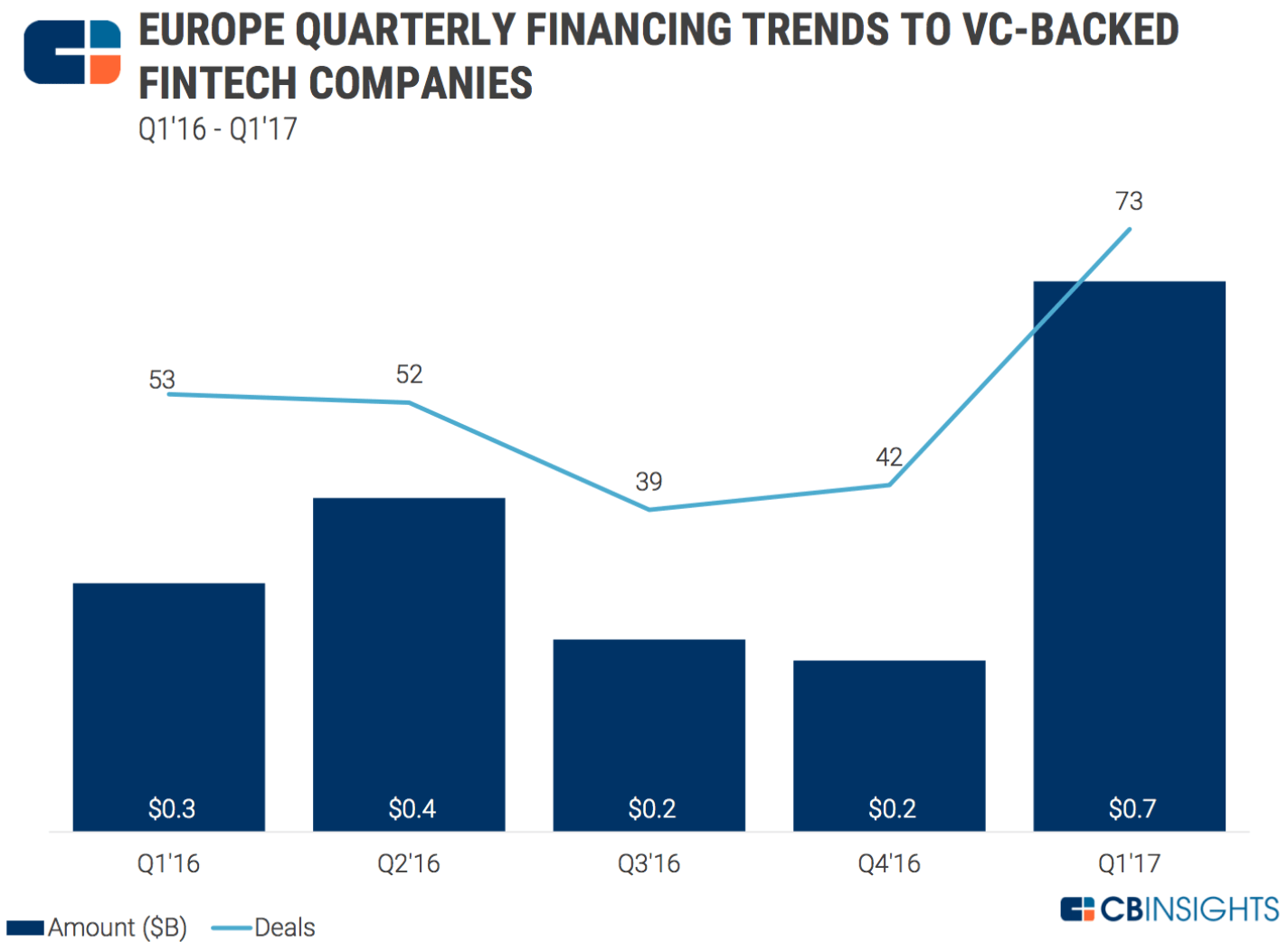

EUROPE FINTECH INVESTMENT SPIKES IN Q1’17

Europe saw a burst of fintech investment in the first three months of 2017, putting total funding dollars on pace to surpass $2.6B at the current run rate. Europe fintech deal activity is on pace to top 2016’s total by 57% if the current pace persists.

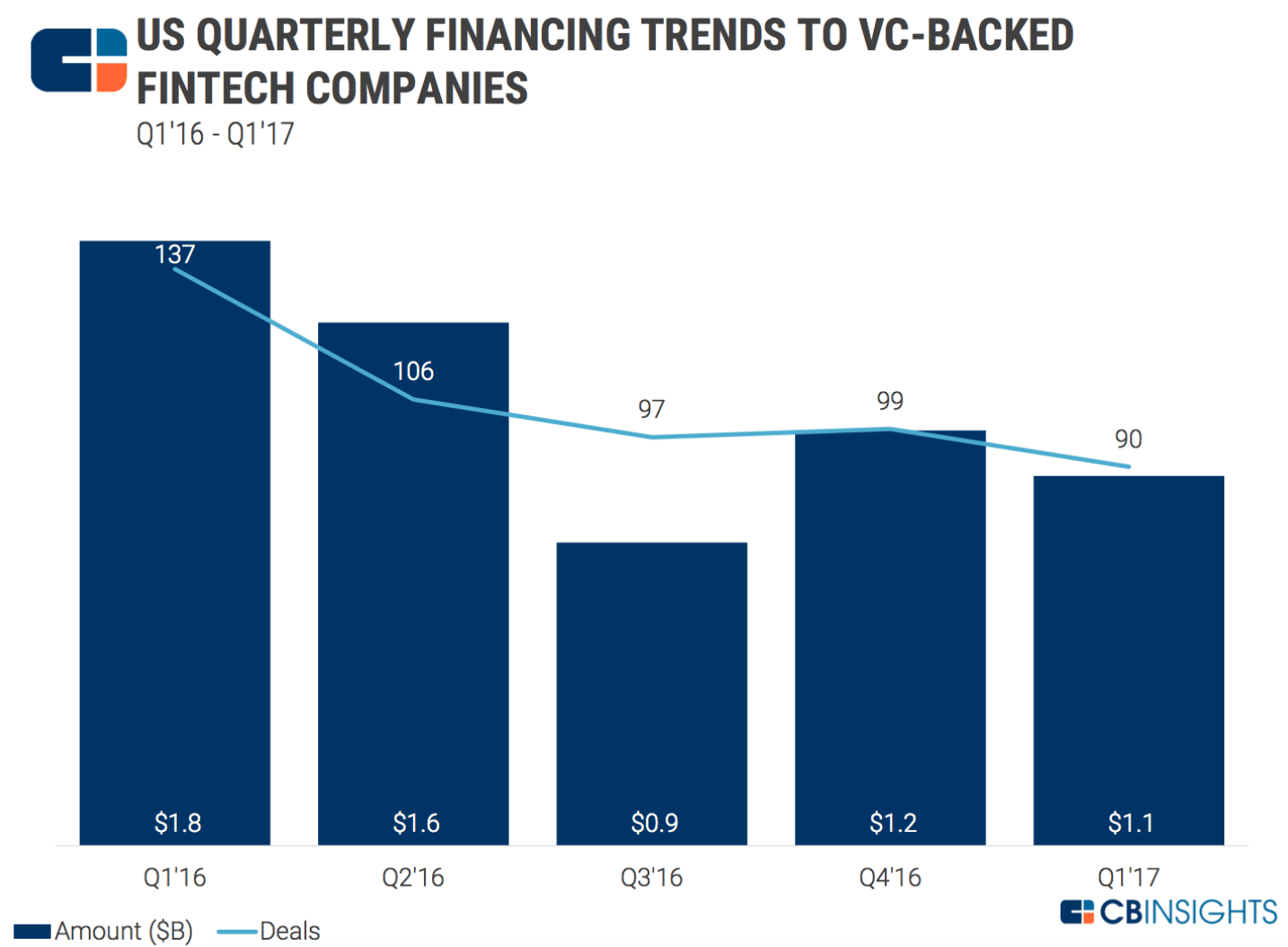

US FINTECH IS ON PACE TO SEE DEALS, DOLLARS DROP IN 2017

If the pace of investment in Q1’17 continues, funding to VC-backed fintech funding would drop 20% from 2016’s dollar total. US fintech deal activity is on pace to fall below 2013 levels at the current run rate.