REPORT HIGHLIGHTS:

CANADIAN TRENDS

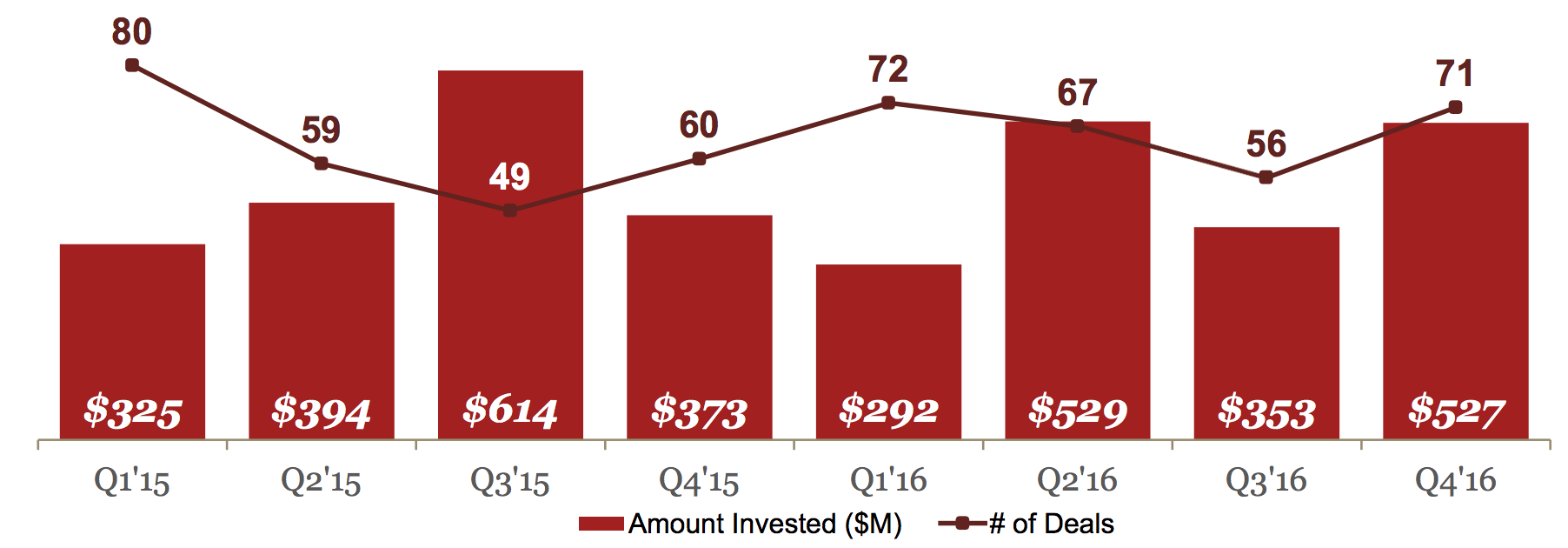

Canadian technology deals and dollars rose in Q4’16, amid global declines.

Annual dollars also climbed from 2015 in top markets of Toronto and Montreal; Vancouver deals rose, but dollars fell.

Internet retains the top sector spot; Mobile & Telecom bumped Healthcare for second place.

Internet of Things and Fintech remain thematic areas across the Canadian landscape.

TOP SECTORS

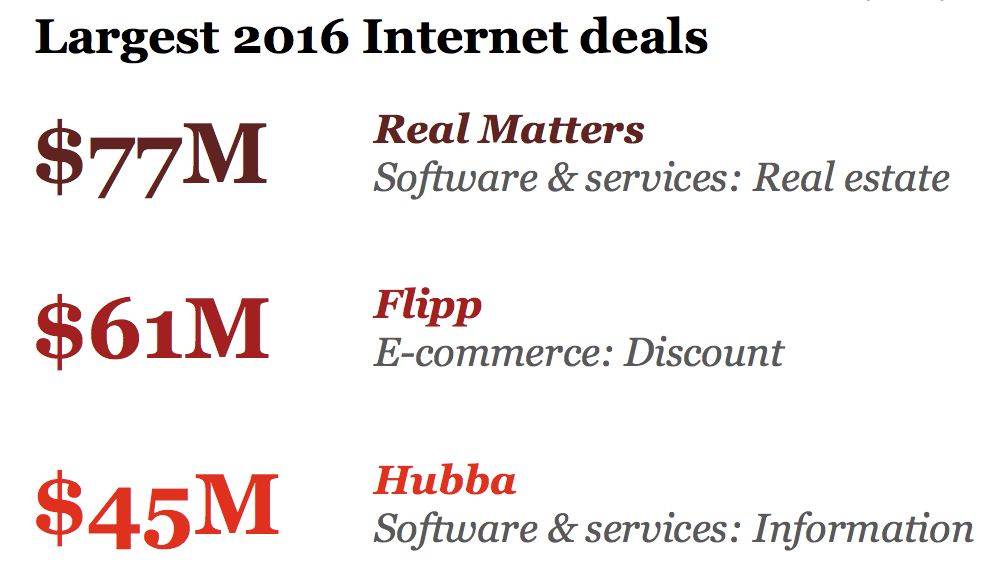

Internet funding for 2016 rose slightly thanks to healthy deal growth.

Mobile & Telecom funding was boosted by several $20M+ deals.

Healthcare funding slipped to third place as deals cooled in 2016.

TOP PLACES

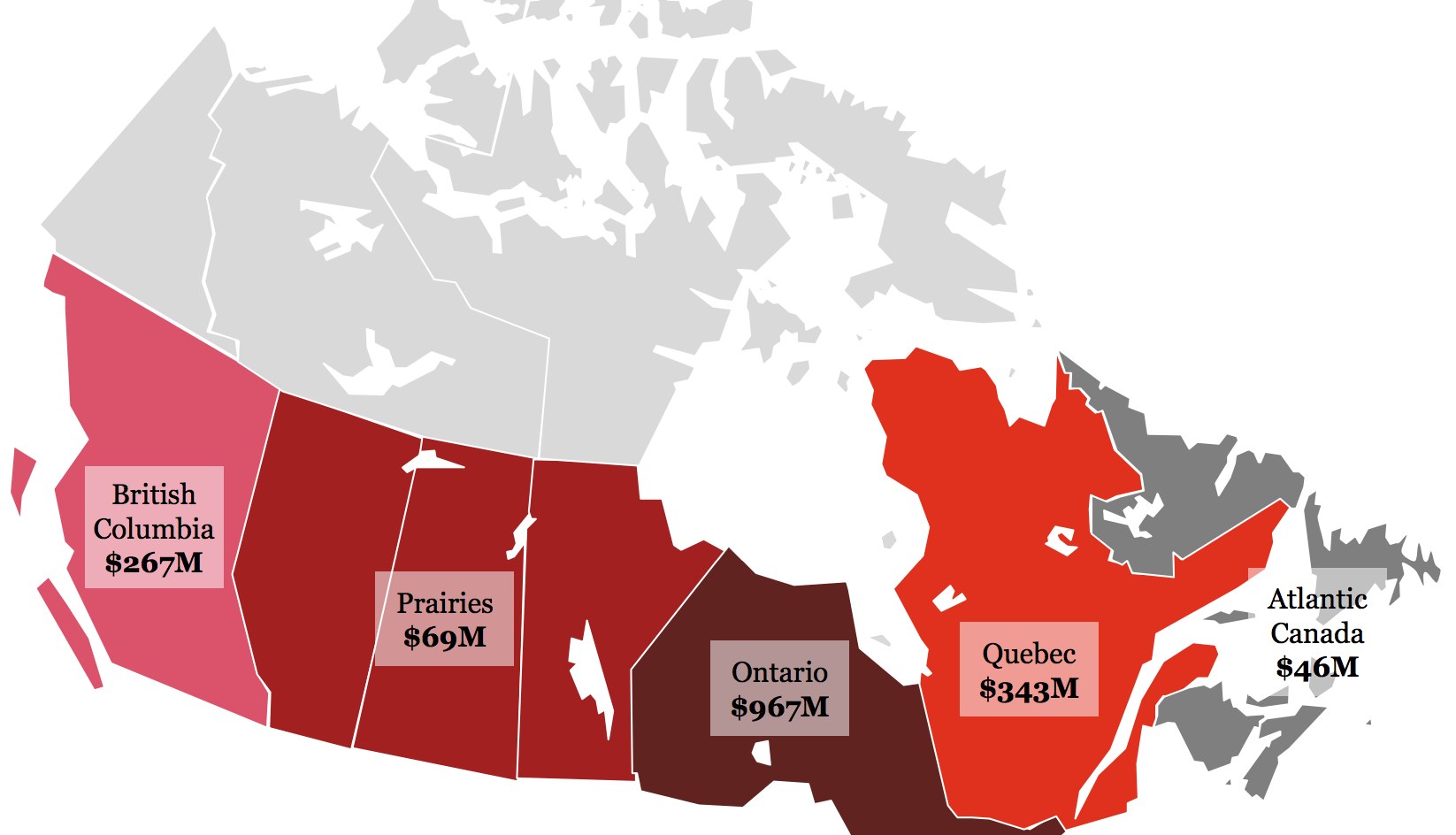

Ontario, Quebec, and BC regions took the lion’s share of financing to VC-backed companies in Canada.

The top five Canadian markets by deal value for 2016 were Toronto, Montreal, Waterloo, Vancouver, and Ottawa.

MOVERS AND SHAKERS

The top five deals of the year accounted for $419M in total dollars secured by companies based in Ontario or Quebec.

The three most active investors of 2016 were BDC, Innovacorp, and Real Ventures.

GLOBAL

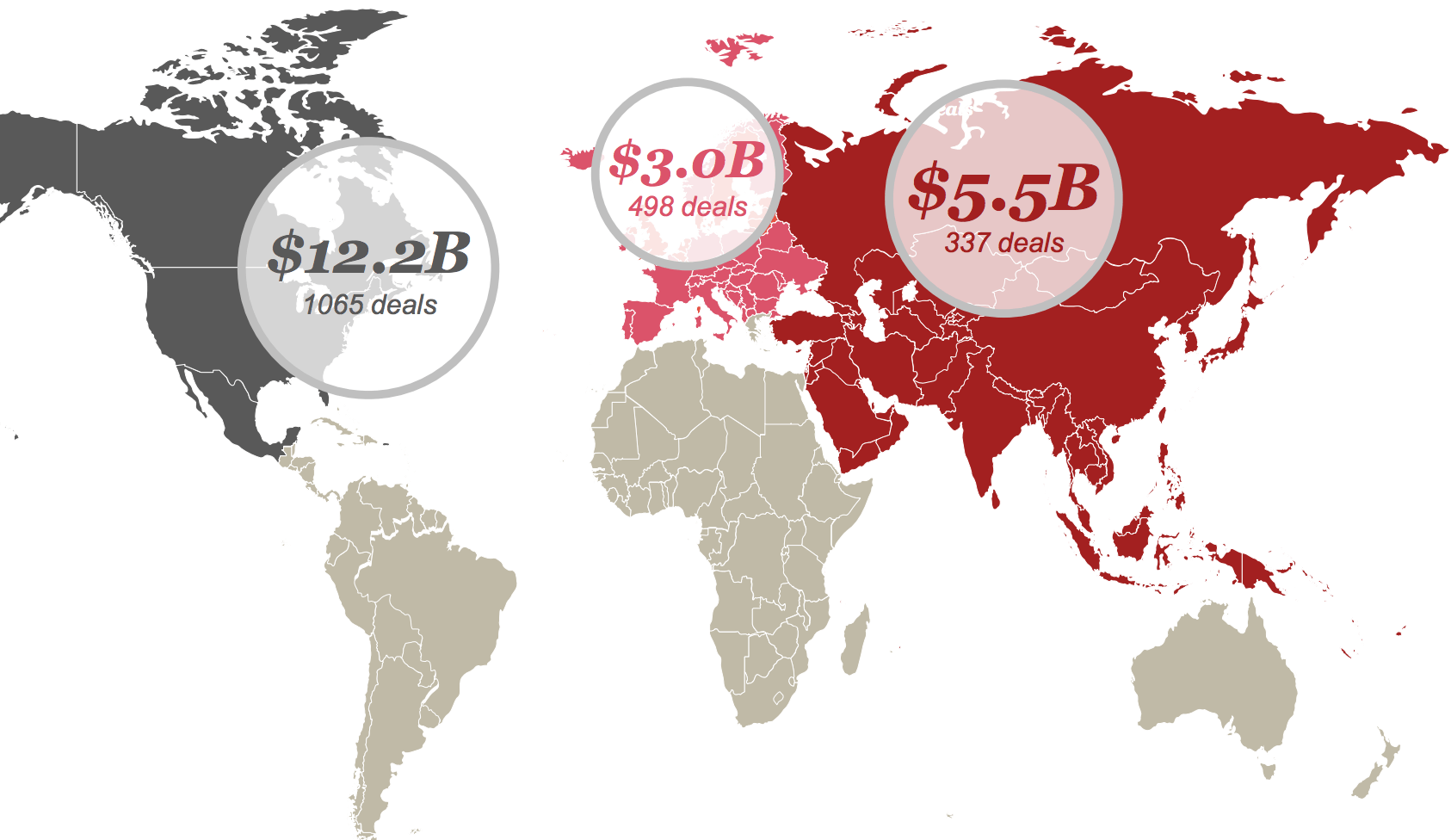

Global deals value dropped 23% on a full year basis versus 2015.

Global deals volume dropped 10% on a full-year basis versus 2015.

If you aren’t already a client, sign up for a free trial to learn more about our platform.