Investments

192Portfolio Exits

42Funds

38Partners & Customers

1Service Providers

1About ICONIQ Capital

ICONIQ Capital is an investment firm that provides investment management services across various sectors, including real assets, growth capital, and impact investing. The company serves institutional and professional investors, partnering with entrepreneurs and visionaries. It was founded in 2011 and is based in San Francisco, California.

Expert Collections containing ICONIQ Capital

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find ICONIQ Capital in 1 Expert Collection, including Synthetic Biology.

Synthetic Biology

382 items

Research containing ICONIQ Capital

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned ICONIQ Capital in 1 CB Insights research brief, most recently on May 8, 2025.

May 8, 2025 report

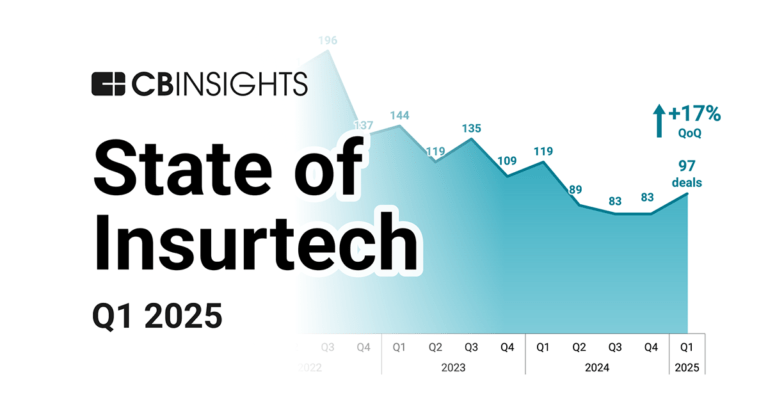

State of Insurtech Q1’25 ReportLatest ICONIQ Capital News

Oct 4, 2025

The VC fundraising landscape has completely transformed in the last 18 months, and most founders still don’t realize just how dramatically the rules have changed. After analyzing 1,000 VC pitch decks and calculating 400,000+ startup valuations on SaaStr.ai , and having countless conversations with both sides of the table, the data is unambiguous: traditional paths to venture funding have essentially closed for the majority of B2B companies. The capital isn’t gone—there’s actually more money in the market than ever. It’s just all flowing to a completely different type of company than it was 24 months ago. Jason Lemkin joined us for a LIVE SaaStr AI Wednesday to walk us through the data, and do live Q+A If you’re a B2B founder growing 60-80% annually at $10-30M ARR with solid unit economics and happy customers, you might think you’re in a strong position to raise. You’re probably not. If you’re planning to raise your Series B based on performance that would have easily secured funding in 2022, you need to recalibrate immediately. And if you’re assuming the next round will come because your current investors keep saying “great job” after each board meeting, you might be months away from a cash crisis you didn’t see coming. This isn’t hyperbole. The benchmarks have shifted so dramatically that roughly 80% of VCs who would have enthusiastically funded solid B2B companies 18-24 months ago are now passing—not because those companies got worse, but because an entirely new category of hypergrowth AI-native startups has reset every expectation in the market. This deep dive breaks down exactly what’s happening, why it’s happening, and—most importantly—what you need to do about it right now. We’ll walk through the actual data from top-tier growth funds, show you the real benchmarks you’re being measured against, and give you a clear-eyed assessment of your options whether you’re pre-revenue, scaling past $10M, or approaching $100M ARR. The worst thing you can do is stay in the dark about where you actually stand. Let’s fix that Top 5 Takeaways The bar for VC funding has skyrocketed dramatically. AI-native companies are now scaling from $1M to $100M ARR in 8-11 quarters (versus the previous “top quartile” benchmark of 19-20 quarters), fundamentally resetting investor expectations across the board. 80% of traditional B2B VCs who would have funded you 18-24 months ago won’t fund you today. Capital is flooding into hypergrowth AI-native companies, leaving traditional SaaS startups—even strong ones—struggling to raise regardless of solid fundamentals. Top quartile metrics are now the minimum bar, not the aspirational goal. At $10-25M ARR, VCs expect 100%+ growth. At $50-100M ARR, they want 90% growth with 120% net revenue retention. Below these numbers, you’ll face an uphill battle regardless of market or team quality. Three consecutive great months can flip you from unfundable to fundable. If you’re close to the benchmarks but not quite there, demonstrating acceleration over 3-4 months can completely change investor perception—but you need to be honest about where you actually stand first. Don’t assume the next round is coming. The single biggest founder mistake is burning cash with the expectation they’ll raise another round. If your odds are below 60-70%, run your company with the cash and revenue you have—not the funding you hope to get. The New Reality: AI-Native B2B Speed vs. Traditional SaaS Growth Let’s start with the chart that explains everything happening in VC right now. Iconiq Capital, one of the leading growth funds originally backed by Mark Zuckerberg’s money, recently published benchmark data that crystallizes the entire market shift. The Old Top Quartile: Getting from $1M to $100M ARR in 19-20 quarters (roughly 5 years) used to represent elite performance—the kind of company VCs actively competed to fund. The New Standard: AI-native companies are doing it in half that time or less: Glean (AI enterprise search): 11 quarters 11 Labs (AI speech): 8 quarters Perplexity: Even faster Cursor, Anthropic, Lovable, Replit: Less than 4 quarters from $1M to $100M Here’s the question every VC is now asking: If you have $100M, $500M, or $2B to deploy, where on this spectrum are you putting your money? The answer is obvious for most—and it’s not with the companies on the right side of that chart, even though they’re very strong “top quartile” performers. These hypergrowth AI companies didn’t even exist 24 months ago. You literally couldn’t invest in them. So the top quartile traditional SaaS companies were about as good as it got. But now? That entire world has been reset. Two Categories of Fundable Companies Bessemer Venture Partners broke down their investment thesis into two distinct categories, and the contrast is striking: Supernovas (AI-Native Companies) Gross margins: Often 25% or even negative (yes, negative) Revenue per employee: $1M+ Examples: Gamma hit $50M ARR in one year; Replit and Lovable are burning massive cash but scaling at unprecedented rates Shooting Stars (The Best of Traditional Software Startups) Growth expectations: $1M → $3M → $12M → $40M → $100M (still better than triple-triple-double-double over 5 years) Gross margins: 60%+ required Key point: Even for these “traditional” companies, the bar has never been higher These AI-native companies often have terrible gross margins because of token costs and infrastructure expenses. But VCs don’t care. They’re remarkably headcount-efficient (often under 100 employees at $50-100M ARR), and the growth trajectory is so explosive that margin concerns become secondary. The Paradox of Public vs. Private Expectations Here’s where things get confusing for founders: while VC expectations for startups have skyrocketed, expectations for public B2B companies have actually declined. Public company reality: “High growth” for public companies is now just 30% (it was 70%+ in 2021) Companies growing 20-30% are getting 20x+ ARR multiples HubSpot is growing 19% and trading at premium valuations Private company reality: The bar keeps rising, not falling You need to massively outperform public company benchmarks to even get a meeting Why the disconnect? Public markets value profitability and predictability at scale. Private markets are chasing the next category-defining winner, and AI has created more potential winners than ever before—meaning the competition for capital is fiercer despite there being more capital available. The Real Benchmarks: What Top Quartile Actually Looks Like Now From Iconiq’s data analyzing their portfolio of venture-backed B2B companies, here are the top quartile benchmarks you need to beat to get funded: Less than $10M ARR: Revenue per employee: $220K Read that carefully. This is not “top 1%” or “exceptional” performance. This is top quartile—meaning 75% of top venture-backed B2B startups fall below these numbers. And yet, this is effectively the minimum bar to get funded by most VCs today. If you’re at $30M ARR growing 60-70%, you are building a truly great company. You might even have excellent fundamentals, happy customers, and strong unit economics. But you’re walking through the desert when it comes to VC funding. Maybe—maybe—you can raise if you have extraordinary circumstances (dominant market share, insane NRR, clear acceleration path), but you’ll need exceptional reasons beyond being likable and having a solid business. The Data from 1,000 Pitch Decks and 400,000 Valuations Through SaaStr AI’s pitch deck review tool (which has now analyzed 1,000+ VC pitch decks in just two weeks), we’re seeing the market reality play out in real-time: Series A averages (across ~108,000 calculations): AI-native companies: ~$5-6M ARR, growing 180% AI-enhanced SaaS: ~$5M ARR, growing 100% Traditional SaaS: ~$5M ARR, growing 75% The traditional SaaS number (75% growth) won’t get you funded in most cases. It’s just not enough. Grade distribution from pitch deck reviews: 17% received A- or above (these are “top tier” and highly fundable) Average grade: B- Median grade: B- Here’s what that means: Most founders are in the B range—they have something, they’re in the zone, but it’s not enough. A B- is not enough to get funded in today’s market. You need to be brutally honest about where you actually stand. What Revenue Efficiency Really Looks Like One trend that’s accelerating: companies are getting dramatically more headcount-efficient as they scale. The Iconiq data shows this progression: Early stage: ~$90K revenue per employee Growth stage: $220K revenue per employee Pre-IPO: $400K revenue per employee The most successful companies—especially AI-native ones—are proving you can get to $50-100M ARR with under 100 employees total. That level of efficiency is becoming the new expectation. How to Navigate This Market: Practical Advice #1. Get Brutally Honest Feedback on Your Actual Funding Odds Don’t go into fundraising blind or optimistic. Use these approaches: Ask your existing investors directly: Put them on the spot. “On a scale of 1-10, how good is our startup? More importantly, what are the exact odds—give me a percentage—that we can raise our next round?” Push for a number. Most experienced investors know exactly what your odds are. Use objective AI tools: Upload your pitch deck to SaaStr AI’s review tool. It will benchmark you against all other founders, tell you where you stand, show you what VCs will think of your traction, and give you honest odds of getting funded. Don’t let ego or optimism cloud your judgment—you need to know where you actually stand. #2. Figure Out What You’re Number One At This has always mattered in venture, but VCs are obsessed with it now. With hundreds of AI SDR tools, thousands of AI startups, and constant innovation noise, you must be number one at something specific. Not “we’re going to be better than the other guy eventually.” Not “we have a great team and we’re executing well.” What are you number one at right now? And show it with data, even if you’re early. Every VC is looking for the next category winner, the next OpenAI of their vertical. If you can’t articulate—and prove—what you’re number one at, you’ll get lost in the noise. #3. Understand Your Zone If you’re above the Iconiq benchmarks: You’ll likely get funded. Maybe not from everyone, but you’ll get multiple term sheets if you have good founders and an interesting space. If you’re within 20% of the benchmarks and burning very little: You’re in the “maybe” zone. Not everyone will want to invest, but you’ll find someone—especially if you have other compelling factors (new product coming, obvious acceleration path, strong market position). Just be prepared to take a lot of meetings. If you’re significantly below the benchmarks: Be honest. It’s going to be incredibly difficult if not impossible. Don’t pretend otherwise. Don’t run out of money because you assumed you could raise. The worst outcome in startup life is going from funded to unfunded and not knowing it until you’re out of cash. #4. The Three-Month Rule If you’re close but not quite fundable, here’s the good news: VCs have incredibly short memories for previous underperformance if you can show recent acceleration. If you’re at $20M ARR growing 70% (below the 90% benchmark), but people are taking meetings because they believe in you and your space, three consecutive great months can completely flip the narrative. Show them one month where instead of growing 6% MoM you grew 10%. Then another month at 10%. Then a third at 10%. By month three or four, investors will stop caring about the previous 30+ months of slower growth. You don’t need a year of great performance. You don’t need 10 years. But you probably do need three solid months, maybe four to be safe. Two months of acceleration will get you meetings, but investors will want to see one more month before committing. Define a clear inflection point (launched AI agents, hired key exec, released version 3.0), explain what changed, and show sustained acceleration from that point forward. #5. Not Everyone is AI-Native or Bust (But 80% Are) The VC world has split into rough camps: ~80% of VCs: Only interested in AI-native, hypergrowth companies. If you’re not building the next Replit or Cursor, they’re out. ~20% of VCs: Still believe in traditional triple-triple-double-double SaaS. These investors (like Rory on the 20VC podcast) argue that if you can hit those benchmarks, they can see a path to IPO at multi-billion dollar valuations, and that’s good enough to make money. The takeaway: Don’t jump off a bridge if you’re not AI-native. You just need to realize the fundraising dating game will be harder. You’ll need more meetings, more outreach, and thicker skin. But the investors exist—they’re just the minority now. #6. Don’t Assume the Next Round is Coming This is perhaps the most critical point: The biggest mistake founders make is assuming they’ll be able to raise another round. Look, if you’re at $20M ARR growing 60%, you’re still compounding toward something potentially great. If you don’t need outside capital and can grow at 50-60% for several years, you’ll build a hundreds-of-millions-dollar company. That’s objectively a great outcome. But no VC will fund you at those metrics in today’s market. So stop operating like the next round is guaranteed. Stop burning cash with the assumption you’ll raise. If your odds are below 60-70% (and be honest—they probably are if you’re not hitting those benchmarks), run your company on the cash and revenue you have. This isn’t bootstrapping shame. This isn’t giving up. This is basic financial reality. Either you can raise money to run at a loss in exchange for hypergrowth, or you can’t. If you can’t, don’t run at a loss. #7. Be Wary of Dated Advice This is subtle but important: many investors haven’t been actively investing recently, or they’re disconnected from what’s actually getting funded in 2025. They’ll give you advice that sounds reasonable but is actually from 2021 or 2022. They’ll tell you your company is “hot as Travis Kelce and Taylor Swift” because you have great unit economics and a strong team. But if you don’t have an ounce of AI in your product and you’re growing like a 2021 company, nobody will actually fund you at the valuations you expect. The same goes for executives you hire. Be extremely careful about VPs of Sales or CMOs who haven’t been in the market since 2021. They’ll want to build teams of 20-40 people, hire 12 people in finance, create 21-person demand gen teams. That model is increasingly dated and unsupportable. Get advice from people who are actively in the market right now. Not people who were successful three years ago but haven’t adapted to the current reality. Special Considerations for Different Stages Pre-Revenue and Pre-Seed Companies If you’re pre-revenue or pre-seed, the signaling game becomes even more important: Join a top accelerator if possible: Y Combinator, Neo, South Park Commons, or Entrepreneur First. Not because the programs themselves will make you a better company (though they might), but because the investor attention is at an all-time high. Yes, it’s somewhat unfair that 20-year-old founders with two weeks of revenue and massive hubris can close rounds at $25-60M post-money valuations just because they’re YC-backed. But that’s the reality. These accelerators attract VCs like flies. If you can’t do an accelerator, you need alternative signals: Epic team (proven founders or engineers with strong reputations can raise pre-revenue) Exceptional pilots (three pilots that could each become multi-million dollar contracts) Early traction metrics (100K users for a free product, 10 real paying customers, something demonstrable) The “Almost There” Companies This might be the toughest spot to be in right now: You’re at $10-20M ARR, growing 50-70%, maybe even cash flow positive or close to it. Through 2023, this is exactly when private equity firms would start calling to buy you. Companies at $15-30M ARR growing 30-50% were getting acquired at 6-10x revenue multiples. That’s largely stopped. PE firms learned that many of these acquisitions (made in 2020-22) haven’t played out as expected. Revenue hasn’t proven as durable, AI is making categories unstable, and growth has decelerated faster than models predicted. What to do: Take PE calls if they come, but don’t expect them like you would have 18 months ago Push forward and get bigger—the PE desert between $10-30M ARR is real right now, but it may not be permanent AI-enhance your product aggressively so you can potentially access either VC funding or PE acquisition in 12-24 months with better metrics Study companies like Filevine (legal case management) that infused true AI agents and raised $400M from Excel at a $3B valuation The Professional Services Question Founders often worry about having 50% professional services revenue versus 50% software ARR. Don’t. Palantir—worth over $300 billion today—was almost entirely low margin software + services until just before going public. Their gross margins were in the teens or 20% range … until suddenly they weren’t. Every VC will tell you services are bad, but Palantir literally proved the opposite at massive scale. More importantly, “forward deployed engineers” are the hottest hiring trend right now (up 12x in the last year according to Iconiq). Why? Because AI products require training, configuration, and month-long deployments. This isn’t technically professional services, but it’s close. Don’t worry about the revenue mix. Worry about whether you have real product-market fit and can scale very rapidly. The SAFE vs. Equity Question Quick primer: Most VCs don’t want to do SAFEs unless the check is immaterial or they have to. SAFEs offer investors no protection, no control over dilution, limited (if any) pro-rata rights, and no board seat. There have been cases where founders simply kept all the SAFE money because legally “it’s neither equity nor debt, so investors have no rights.” When do SAFEs make sense? Large funds writing tiny checks ($100K from a multi-billion dollar fund—they don’t care) Forced by accelerators (YC makes you use SAFEs; everyone accepts it for small amounts) For a $2M raise, you might be able to do it on a SAFE, but unless you have a hot hand, don’t push it. Optimize for getting the deal done, not the specific instrument. Don’t over-optimize on terms that don’t really matter if it means losing the deal. Understanding Valuation Expectations Here’s an uncomfortable truth: Not only have VC expectations gone up, but founder valuation expectations have also skyrocketed—especially for AI companies. Recent Y Combinator batches have had founders with minimal revenue raising at $25-60M post-money valuations, hoping to triple that in another round within a year. From the VC side, that’s an extraordinarily difficult bet to make work economically. So you have VCs expecting faster growth and founders expecting higher prices with lower dilution. This puts pressure on the entire model. You might get the term sheet, but the performance expectations will be equally extreme. The Bottom Line The venture capital market in 2025 has fundamentally bifurcated: The winners: AI-native companies scaling at unprecedented rates (even with negative gross margins), and exceptional traditional SaaS companies hitting 100%+ growth at $25M+ ARR with strong margins and capital efficiency. Everyone else: Walking through a funding desert, regardless of having solid businesses, happy customers, or reasonable growth rates. This isn’t fair. It isn’t rational in many ways. A company growing from $20M to $35M in a year (75% growth) is still building something substantial and valuable. But VCs are human, capital is following the most explosive growth stories, and you can’t fight the market. What you can do is be ruthlessly honest about where you stand, understand your actual odds, make informed decisions about burn rate and runway, and either position yourself to hit the benchmarks or run a sustainable business without assuming the next round will materialize. The worst outcome isn’t building a $100M revenue company over 10 years instead of 3 years. The worst outcome is running out of money because you didn’t realize the rules had changed. Top Things Founders Need to Know Right Now Use objective tools to assess your fundability. Don’t rely on gut feel, friendly advisors, or outdated advice. Upload your deck to SaaStr AI, ask your investors point-blank for percentage odds, and benchmark yourself against current market data—not 2021 metrics. If you’re not AI-native and not hitting top quartile growth, prepare for 5x more meetings. You’ll need to talk to everyone. Get comfortable with rejection. Have a thick skin. The investors who will fund you exist, but they’re now the minority. Three great months can change everything. If you’re close but not quite there, focus obsessively on showing acceleration over 90-120 days. Define your inflection point clearly, show consistent execution, and investors will forgive previous underperformance. Make the cash you have last. Run your company as if the next round isn’t coming unless you’re highly confident (>70% odds) you can raise. The biggest failure mode is burning through capital while assuming funding is inevitable when it’s not. Be number one at something specific and provable. “We’re going to be great” doesn’t cut it. “We have 10x the accuracy of competitors as measured by [specific metric]” or “We’re the fastest-growing solution in [narrow category] with [specific data]” is what VCs want to hear. Don’t confuse PE recapitalizations with venture rounds. If someone wants to give you $20M but take 50% of your company, that’s not growth capital—it’s a partial buyout. These deals exist and might make sense, but they’re fundamentally different from venture funding. The bar is high and getting higher, but it’s not arbitrary. VCs are comparing you against the fastest-growing companies in history. They’re not trying to be mean—they’re trying to make returns in a market where AI-native companies are redefining what’s possible. Your job is to either meet that bar or build a great business without venture capital. The market has spoken. The only question is whether you’re going to listen and adapt accordingly. For more resources, benchmark your company for free at SaaStr AI (saastr.ai), where you can get instant valuations, pitch deck reviews, and see how you stack up against thousands of other B2B startups in real-time. Related Posts

ICONIQ Capital Investments

192 Investments

ICONIQ Capital has made 192 investments. Their latest investment was in Big Brand Tire & Service as part of their Recap on October 02, 2025.

ICONIQ Capital Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

10/2/2025 | Recap | Big Brand Tire & Service | Yes | 4 | ||

9/4/2025 | Series B | Lead Bank | $70M | Yes | 6 | |

9/2/2025 | Series F | Anthropic | $13,000M | Yes | Altimeter Capital, Baillie Gifford, BlackRock, Blackstone, Coatue, D1 Capital Partners, Fidelity Investments, General Atlantic, General Catalyst, GIC, Goldman Sachs Alternatives, Insight Partners, Jane Street Group, Lightspeed Venture Partners, Ontario Teachers' Pension Plan, Qatar Investment Authority, T. Rowe Price, TPG, UNIQ Investments, WCM Investment Management, and XN | 11 |

8/20/2025 | Series A | |||||

8/6/2025 | Series B |

Date | 10/2/2025 | 9/4/2025 | 9/2/2025 | 8/20/2025 | 8/6/2025 |

|---|---|---|---|---|---|

Round | Recap | Series B | Series F | Series A | Series B |

Company | Big Brand Tire & Service | Lead Bank | Anthropic | ||

Amount | $70M | $13,000M | |||

New? | Yes | Yes | Yes | ||

Co-Investors | Altimeter Capital, Baillie Gifford, BlackRock, Blackstone, Coatue, D1 Capital Partners, Fidelity Investments, General Atlantic, General Catalyst, GIC, Goldman Sachs Alternatives, Insight Partners, Jane Street Group, Lightspeed Venture Partners, Ontario Teachers' Pension Plan, Qatar Investment Authority, T. Rowe Price, TPG, UNIQ Investments, WCM Investment Management, and XN | ||||

Sources | 4 | 6 | 11 |

ICONIQ Capital Portfolio Exits

42 Portfolio Exits

ICONIQ Capital has 42 portfolio exits. Their latest portfolio exit was Netskope on September 18, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/18/2025 | IPO | Public | 4 | ||

7/31/2025 | IPO | Public | 6 | ||

6/12/2025 | IPO | Public | 4 | ||

ICONIQ Capital Acquisitions

4 Acquisitions

ICONIQ Capital acquired 4 companies. Their latest acquisition was Truckstop.com on April 03, 2019.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

4/3/2019 | Private Equity | Acq - Fin | 3 | |||

8/15/2016 | Debt | |||||

6/18/2015 | ||||||

8/15/2013 |

Date | 4/3/2019 | 8/15/2016 | 6/18/2015 | 8/15/2013 |

|---|---|---|---|---|

Investment Stage | Private Equity | Debt | ||

Companies | ||||

Valuation | ||||

Total Funding | ||||

Note | Acq - Fin | |||

Sources | 3 |

ICONIQ Capital Fund History

38 Fund Histories

ICONIQ Capital has 38 funds, including ICONIQ Strategic Partners VII.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

7/22/2024 | ICONIQ Strategic Partners VII | $5,750M | 1 | ||

4/26/2024 | ICONIQ Strategic Partners VII-B | $3,954.36M | 2 | ||

12/17/2020 | IPI Partners II-A | $1,145.53M | 1 | ||

12/17/2020 | IPI Partners II-B | ||||

12/17/2020 | ICQ Investments RS |

Closing Date | 7/22/2024 | 4/26/2024 | 12/17/2020 | 12/17/2020 | 12/17/2020 |

|---|---|---|---|---|---|

Fund | ICONIQ Strategic Partners VII | ICONIQ Strategic Partners VII-B | IPI Partners II-A | IPI Partners II-B | ICQ Investments RS |

Fund Type | |||||

Status | |||||

Amount | $5,750M | $3,954.36M | $1,145.53M | ||

Sources | 1 | 2 | 1 |

ICONIQ Capital Partners & Customers

1 Partners and customers

ICONIQ Capital has 1 strategic partners and customers. ICONIQ Capital recently partnered with i80 Group on February 2, 2022.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

2/17/2022 | Partner | United States | Venture Debt Company i80 Group Partners with ICONIQ Capital - Sovereign Wealth Fund Institute Silicon Valley wealth management firm ICONIQ Capital is partnering with i80 Group . | 3 |

Date | 2/17/2022 |

|---|---|

Type | Partner |

Business Partner | |

Country | United States |

News Snippet | Venture Debt Company i80 Group Partners with ICONIQ Capital - Sovereign Wealth Fund Institute Silicon Valley wealth management firm ICONIQ Capital is partnering with i80 Group . |

Sources | 3 |

ICONIQ Capital Team

83 Team Members

ICONIQ Capital has 83 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Divesh Kanthylal Makan | Morgan Stanley, and Goldman Sachs | Founder | Current |

Name | Divesh Kanthylal Makan | ||||

|---|---|---|---|---|---|

Work History | Morgan Stanley, and Goldman Sachs | ||||

Title | Founder | ||||

Status | Current |

Compare ICONIQ Capital to Competitors

One Peak Partners operates as an equity investment firm. The company provides capital and support to growing technology companies with proprietary technology, business models, and management teams. It primarily invests in technology entrepreneurs. The company was founded in 2014 and is based in London, United Kingdom.

Rock Health Capital operates as a venture capital firm focusing on the intersection of healthcare and technology. The firm provides investment and advisory services to entrepreneurs at the earliest stages of company development, with a focus on digital health innovations. It primarily serves the digital health sector, supporting startups that aim to improve healthcare through technology. It was founded in 2010 and is based in San Francisco, California.

Chicago Poland Ventures facilitates investment fund focusing on early-stage companies in medical technologies. The fund provides financial support and assistance to innovative companies, particularly those developing technology and products in biotechnology, pharmaceuticals, artificial intelligence, medical devices, information technology, diagnostics, genomics, and healthcare. It primarily serves the healthcare and technology sectors, aiding projects in the proof of concept and proof of principle phases. It was founded in 2020 and is based in Elk Grove Village, Illinois.

Belay operates as a global investment firm focused on the financial services sector. The company specializes in providing strategic guidance and resources to companies for scaling and market leadership through expansion and acquisitions. It primarily serves the financial services industry, including fintech companies and investment advisors. It was founded in 2020 and is based in Newport Beach, California.

Andreessen Horowitz invests in technology companies across various stages and sectors, including consumer, enterprise, bio/healthcare, crypto, fintech, and games industries. It was founded in 2009 and is based in Menlo Park, California.

S2G Ventures is a multi-stage investment firm with a focus on venture and growth-stage businesses in the food, agriculture, oceans, and energy sectors. The company provides capital, mentorship, and resources to startups pursuing market-based solutions that aim to generate positive social, environmental, and financial returns. S2G Ventures offers flexible capital solutions ranging from seed and venture funding to growth equity and infrastructure financing. S2G Ventures was formerly known as Seed 2 Growth. It was founded in 2014 and is based in Chicago, Illinois.

Loading...