In 2016, 831 investments went to VC-backed fintech startups, only slightly down from 2015′s record of 848 investments. And while overall investment pace slowed last year, Southeast Asia saw the greatest number of fintech deals to the region to-date.

Using CB Insights data, we took a deep dive into Southeast Asia fintech funding trends. Funding to fintech companies in the region has gone from minimal investment in 2012 to over $150M invested in each of the past two years.

This research brief on Southeast Asia’s fintech landscape covers:

- Annual financing trends

- Quarterly financing trends

- Annual financing trends by stage

- Deal share by country

- The most active investors

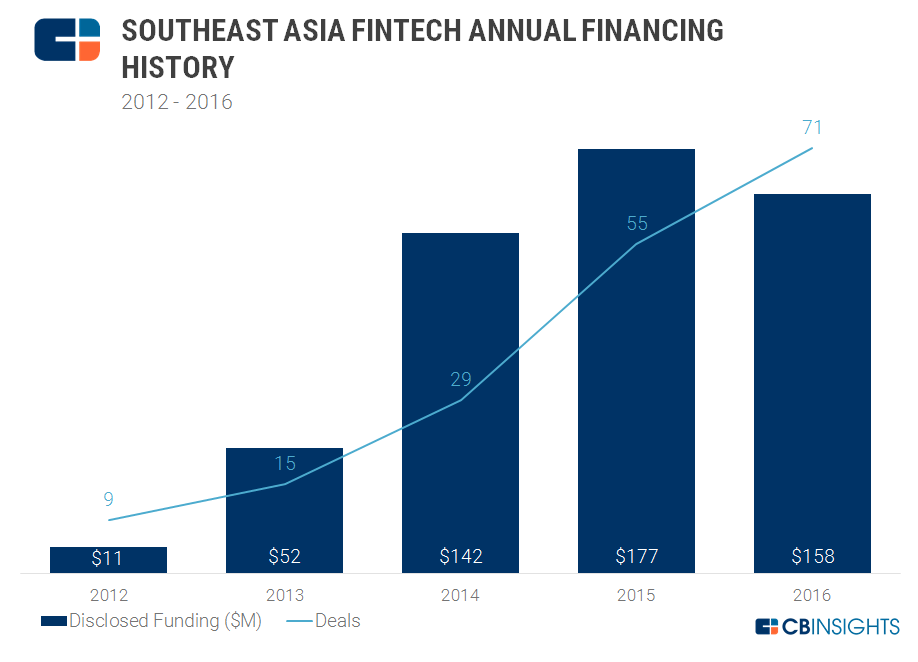

Southeast Asia fintech annual financing

Deals to venture-backed fintech companies in Southeast Asia — specifically Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam — rose 29% last year, from 55 in 2015 to 71 in 2016. Meanwhile, dollars fell 12%, from $177M in 2015 to $158M in 2016 as deal growth was largely driven by seed/angel stage investments.

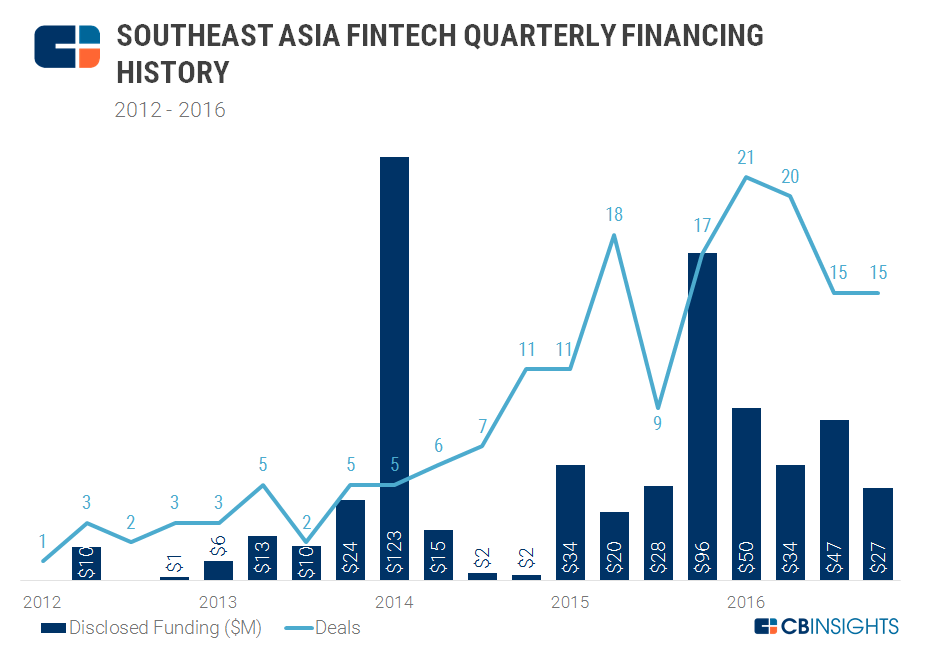

Southeast Asia fintech quarterly financing

2016 started strong with 21 financings in Q1’16, a record quarter for deals to Southeast Asian fintech companies. In Q3’16 and Q4’16, though, deal count was down to 15. Reflecting the year’s overall strength, only two prior quarters performed better than 2016’s worst quarters: Q2’15 and Q4’15, with 18 and 17 financings, respectively.

In terms of funding dollars, 2016 averaged about $40M per quarter, down from $44M in 2015. The largest deal of 2016 went to Vietnam-based mobile payments platform MoMo, in a $28M Series B that included Goldman Sachs and Standard Chartered as investors. Other deals included a $17.5M investment to Thailand-based payments enabler Omise, a $2M investment to Singapore payments provide Coda Payments, and a $3M investment to Malaysia-based financial comparison startup Jirnexu.

Southeast Asia fintech annual deal share, by stage

Looking at deals by stage, a couple of interesting trends emerge. 2016 saw the first Series D financing to the region’s fintech companies, with merchant payments platform 2C2P closing on an $8M Series D. As noted above, seed and angel deals also increased, from 55% in 2015 to 62% in 2016.

Coupled with 29% deal growth, investor interest also went up significantly in 2016 — the number of unique investors to the Southeast Asian fintech companies grew 60%, from 70 in 2015 to 112 in 2016.

Southeast Asia fintech deal share, by country

Looking at deal share by country, over half of all Southeast Asian fintech deals went to Singapore-based companies, which is not especially surprising given the city-state’s position as a global financial hub.

Funding Societies, a P2P lending platform for small and medium enterprises, received one of the country’s larger 2016 rounds: a Q3’16 $7.5M Series A that included Sequoia Capital India and Alpha JWC Ventures as investors.

After Singapore, the Philippines took the next greatest share of deals at 14%.

The most active investors in Southeast Asia fintech

East Ventures took the top spot as the most active Southeast Asia fintech investor since 2012, with 12 unique investments, followed by 500 Startups and Golden Gate Ventures. Of note, Ant Financial, the financial affiliate of Alibaba, has made 3 investments in Southeast Asia as it looks to expand into new markets including most recently Ascend Money in Thailand and Philippines-based digital payments provider Mynt.

| Rank | Investor |

|---|---|

| 1 | East Ventures |

| 2 | 500 Startups |

| 3 | Golden Gate Ventures |

| 4 | GMO VenturePartners |

| 4 | IMJ Investment Partners |

| 6 | CyberAgent Ventures |

| 6 | Life.SREDA |

| 8 | Wavemaker Partners |

| 8 | Jungle Ventures |

| 8 | Ant Financial Services Group |

Want more data about fintech startups? Log in to CB Insights or sign up for free below.

If you aren’t already a client, sign up for a free trial to learn more about our platform.