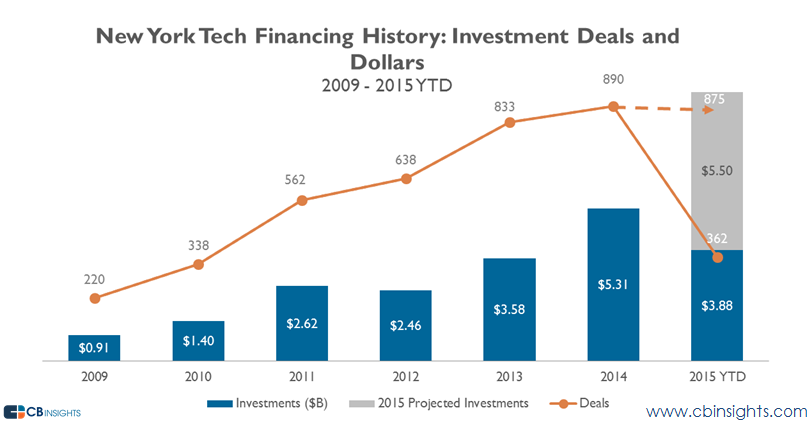

New York is one of the top markets for tech funding in the United States, with local startups raising over $20B across 3,800 deals since 2009. Deal activity has increased every year since 2009, reaching 890 deals in 2014. Funding is on track to reach a 7-year high in 2015, with over $3.8B in funding already this year.

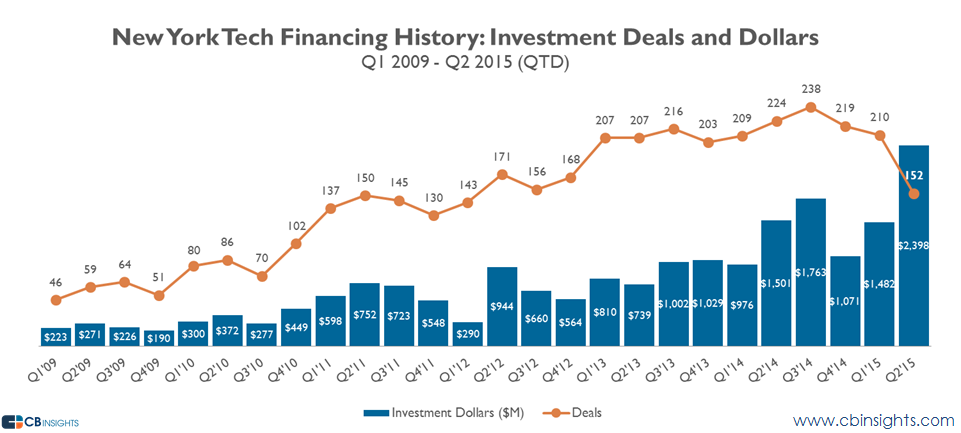

On a quarterly basis, 7 of the last 8 quarters have topped $1B in total funding for New York tech startups. Deal activity has kept pace, with 9 of the last 10 quarters topping 200 deals. The last four quarters, including Q2’15, saw a combined $6.7B in funding, 49% more than the previous four quarters. Overall, 2014 deals and dollars have grown 305% and 483%, respectively, versus 2009.

*The chart above shows deals and dollars through June 5, 2015

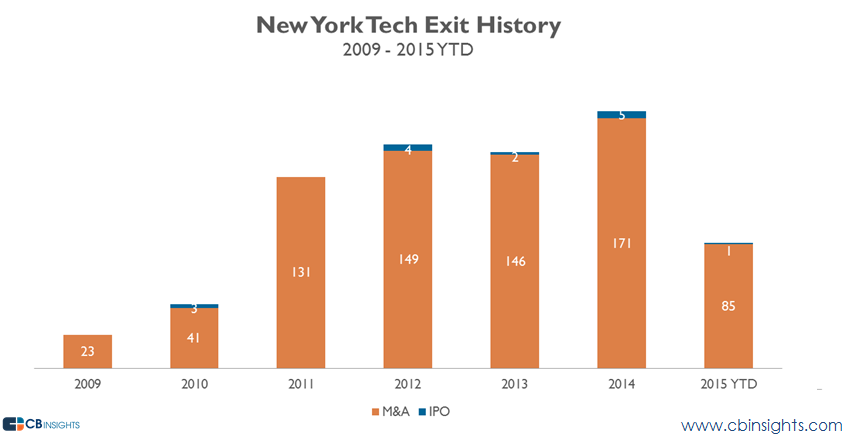

NY-based tech exits have also picked up, as 2014 saw the highest exit total of the past six years. The exits have largely been driven by M&A. However, 2014 did reach a six-year high for IPOs with five, including those of OnDeck Capital, Varonis Systems, and others.

There has been at least one New York-based, VC-backed tech exit at a $1B+ valuation in each of the past three years. Etsy’s IPO in April 2015 at a valuation of $1.7B was the largest ever for a VC-backed New York-based tech company. OnDeck Capital went public in 2014. Tumblr was acquired by Yahoo for $1.1B in 2013.

| Rank | Company | Acquirer | Year | Valuation ($M) |

|---|---|---|---|---|

| 1 | Etsy | IPO | 2015 | $1,775 |

| 2 | OnDeck Capital | IPO | 2014 | $1,323 |

| 3 | Tumblr | Yahoo | 2013 | $1,100 |

| 4 | Buddy Media | Salesforce | 2012 | $745 |

| 5 | Shutterstock | IPO | 2012 | $570 |

| 6 | Varonis Systems | IPO | 2014 | $524 |

| 7 | Tremor Video | IPO | 2013 | $494 |

| 8 | Borderfree | IPO | 2014 | $488 |

| 9 | Everyday Health | IPO | 2014 | $415 |

| 10 | MakerBot Industries | Stratasys | 2013 | $403 |

When it comes to activity, no VC has been more active in New York’s tech scene than Lerer Hippeau Ventures. LHV has invested in over 100 New York-based tech companies since 2009, including notable investments in BuzzFeed and Warby Parker. SV Angel and BoxGroup rounded out the top 3 rankings with investments in over 70 New York-based tech companies each since 2009.

| Rank | Investor | Rank | Investor |

|---|---|---|---|

| 1 | Lerer Hippeau Ventures | 9 | FirstMark Capital |

| 2 | BoxGroup | 12 | Greycroft Partners |

| 3 | SV Angel | 12 | Spark Capital |

| 4 | RRE Ventures | 14 | Thrive Capital |

| 5 | Founder Collective | 15 | Slow Ventures |

| 6 | First Round Capital | 16 | Union Square Ventures |

| 7 | Softbank Capital | 17 | General Catalyst Partners |

| 8 | Social Starts | 18 | Contour Venture Partners |

| 9 | 500 Startups | 18 | IA Ventures |

| 9 | Great Oaks Venture Capital | 18 | Primary Venture Partners |

Want more data around New York’s tech industry? Check out the New York Tech Almanac, login to CB Insights, or sign up for free below.

If you aren’t already a client, sign up for a free trial to learn more about our platform.