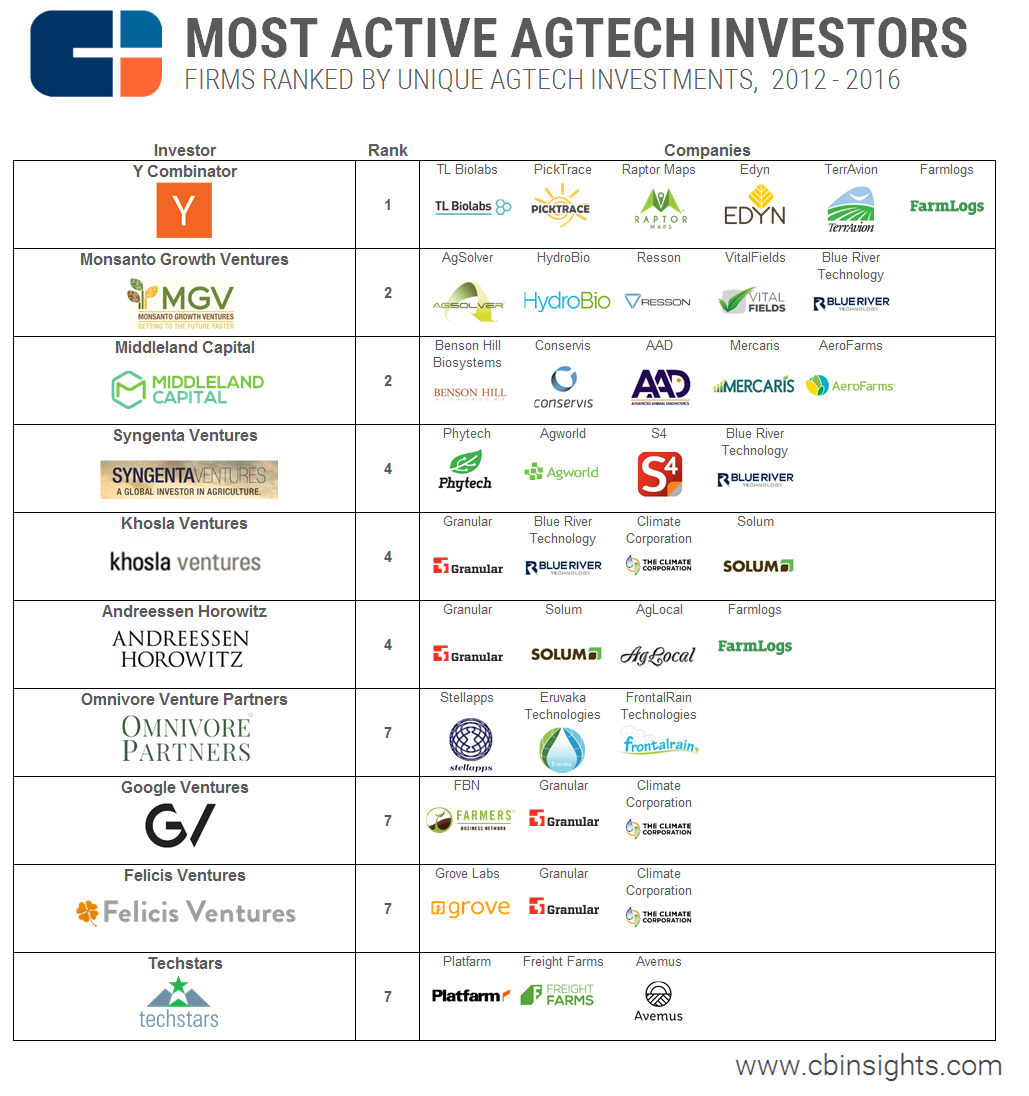

Since the $1B+ acquisition of The Climate Corporation, investor interest in private ag tech companies has increased rapidly. Which investors have been active in the growing space? We used CB Insights database to map the most active investors based on unique investments between 2012-2016.

Note: We include ag tech companies focused on software and tech-enabled products aimed at the agricultural sector. Biotechnology companies were not included.

Y Combinator tops the list with investments in 6 different ag tech companies since 2012. Another accelerator, Techstars, also made the list with 3 unique investments in Platfarm, Freight Farms, and Avemus. Corporate VCs were 3 of the top 10 most active investors, coming from both the agribusiness (Syngenta, Monsanto) and tech (Google Ventures) sides.

Middleland Capital, a DC-based early stage venture firm, has also made a strong push into the agriculture space in both the technology and biotechnology parts of the sector. However, biotech investments are excluded from the table below. The ag tech-focused fund’s investments include Conservis, Advanced Animal Diagnostics, and Mercaris. Omnivore is the other ag tech-focused fund on the most active list.

Several generalist VCs also made the list, including Andreessen Horowitz, Felicis Ventures, and Khosla Ventures. All three share Granular as an investment.

Track all the Ag Tech startups in this brief and many more on our platform

Startups are working to build infrastructure around this rapidly growing industry. Sign up for a free trial and look for Ag Tech Startups in the Collections tab.

Track AgTech startupsWant more info on Ag Tech companies? Check out our public collection or sign up for our private market database below.

If you aren’t already a client, sign up for a free trial to learn more about our platform.