Investments

160Portfolio Exits

30Funds

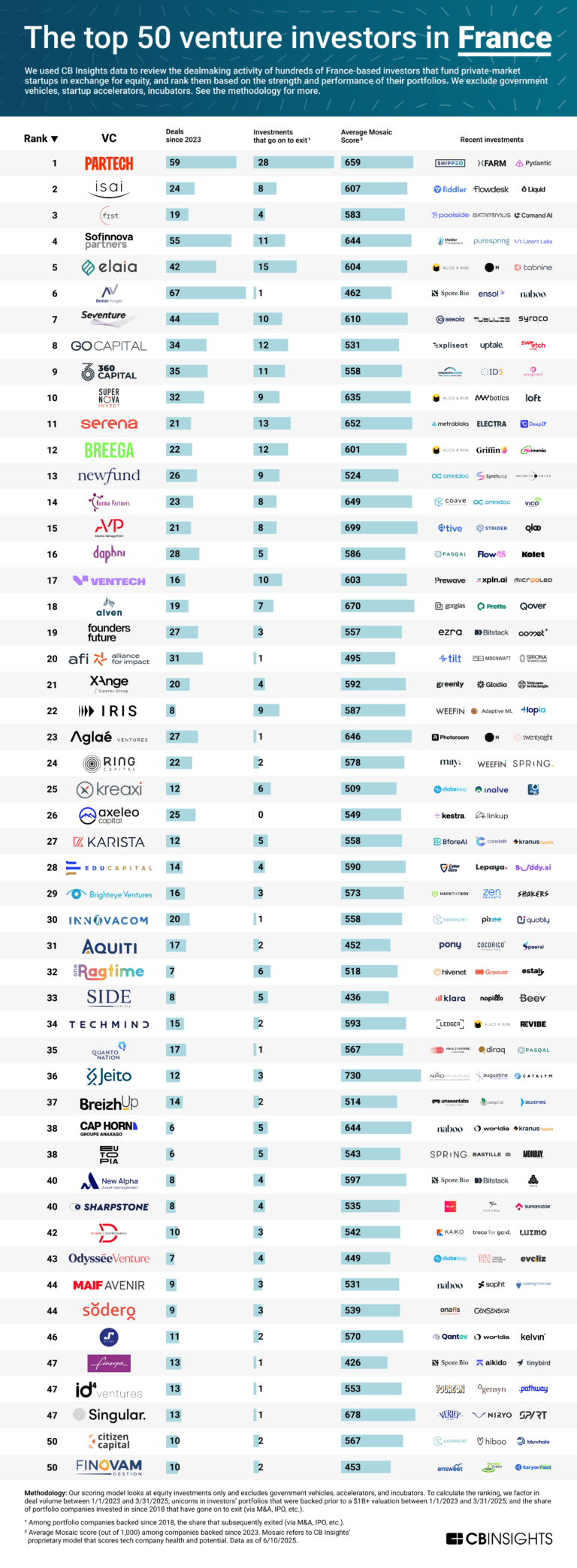

11Research containing ISAI

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned ISAI in 1 CB Insights research brief, most recently on Jun 13, 2025.

Jun 13, 2025

The top 50 venture investors in FranceLatest ISAI News

Sep 22, 2025

TEMELION LÈVE 3,2 M€ POUR SIMPLIFIER LA CONCEPTION DU BÂTIMENT GRÂCE À L’IA Paris, France, le 16 eme septembre 2025 — Temelion, la plateforme d’Intelligence Artificielle qui révolutionne la conception des bâtiments pour les équipes d’ingénierie, annonce une levée de fonds en amorçage de 3,2 M€. Ce tour de table, mené par 360 Capital avec la participation d’ISAI Build Venture, SE Ventures et Kima Ventures, marque une étape clé dans le développement de la startup. Cette opération lui permettra d’accélérer sa mise sur le marché et de renforcer sa présence auprès des Bureaux d’Études Techniques (BET) en France. Les Fondateurs de Temelion (G - D): Rodolphe Héliot, Jérôme Joaug, Sébastien Gilles Présente à Paris et à Toulouse, Temelion ambitionne de simplifier les processus complexes d’ingénierie du bâtiment grâce à l’Intelligence Artificielle. Sa vocation est de libérer les ingénieurs des tâches répétitives afin qu’ils puissent se concentrer sur les tâches techniques qui constituent la véritable valeur de leur métier. Temelion leur permet de produire des livrables fiables, conformes aux normes, et ce dans des délais réduits et à moindre coût. Concrètement, la plateforme automatise les tâches chronophages des ingénieurs, garantit la cohérence entre les exigences clients et les livrables, et accroît la réactivité lors des phases d’appel d’offres. Elle permet également de générer une documentation technique fiable et de simplifier l’évaluation des offres des installateurs. En intégrant progressivement des workflows spécialisés dans l’électricité, le CVC et la plomberie, Temelion construit une suite complète d’outils métiers pensée pour accélérer la conception, accroître la précision et renforcer la qualité des projets. Fondée en 2025 par Jérôme Joaug, Rodolphe Héliot et Sébastien Gilles, la société s’appuie sur une équipe d’entrepreneurs aguerris cumulant des décennies d’expérience en tant que fondateurs, investisseurs et dirigeants de sociétés à forte croissance. Leurs parcours, marqués par des réussites entrepreneuriales, témoignent d’une expertise rare, nourrie par une passion commune pour le bâtiment, la construction durable et la technologie. Tous trois ont également consacré de nombreuses années au développement d’outils logiciels conçus pour des environnements particulièrement complexes et exigeants. Ce financement, mené par 360 Capital aux côtés d’ISAI Build Venture, SE Ventures et Kima Ventures, ainsi que des business angels issus du secteur de la construction, permettra à Temelion de : Renforcer ses équipes d’ingénierie pour étendre son offre de workflows IA : génération de propositions techniques, analyse des appels d’offres, conformité réglementaire, etc. Accélérer son déploiement commercial en France, en ciblant en priorité les Bureaux d’Études Techniques. Avec des besoins croissants de rénovation du parc bâti, la montée en puissance des infrastructures technologiques et de transport, et des exigences réglementaires toujours plus fortes, les bureaux d’ingénierie français sont confrontés à des projets toujours plus complexes et stratégiques. Dans ce contexte, Temelion se positionne comme un allié technologique essentiel pour ces entreprises qui doivent livrer avec rapidité, qualité et valeur ajoutée. Investir dans l’accompagnement client, le support métier et les intégrations aux outils standards (tels que les outils CAD, REVIT ou les logiciels de calcul et de simulation), pour s’inscrire au plus près du quotidien des Bureaux d’Études Techniques. Jérôme Joaug, cofondateur et Directeur Produit: « Lors de nos premiers échanges avec les ingénieurs, nous nous attendions à une certaine forme de résistance vis-à-vis de l’IA. Au lieu de ça, c’est une frustration unanime face aux heures passées à traiter des documents qui nous a été partagée— un travail auquel aucun ingénieur n’avait jamais aspiré, mais qui occupe pourtant une grande partie de leur quotidien. Temelion a été créé pour les libérer de ces tâches fastidieuses et leur permettre de se concentrer sur les dimensions techniques de l’ingénierie qu’ils aiment réellement ». Rodolphe Héliot, cofondateur et PDG de Temelion: « Cette levée de fonds permet à Temelion de réunir les meilleurs talents en IA et en ingénierie du bâtiment pour relever un grand défi de la construction : l’automatisation de la conception. Nous allons accélérer le développement de nos produits et leur mise sur le marché, avec l’ambition de devenir rapidement le partenaire technologique privilégié de nos clients, capable de les accompagner tout le long du cycle projet.». Alexandre Mordacq, Partner à 360 Capital : « Temelion illustre la manière dont l’IA peut répondre à des besoins concrets dans des secteurs complexes comme la construction. Leur approche s’inscrit pleinement dans notre ADN d’investisseur early stage : soutenir des équipes visionnaires qui mettent la technologie au service de l’efficacité, de la durabilité et de la transformation d’industries stratégiques. Nous sommes convaincus que Temelion peut devenir un acteur de référence pour les bureaux d’études en France et dans le monde, et nous sommes heureux de les accompagner dès cette étape clé. » À propos de Temelion Temelion est une startup française spécialisée dans la technologie pour le secteur de la construction, basée à Station F à Paris ainsi qu’à Toulouse. Temelion est une plateforme d’Intelligence Artificielle spécifiquement conçue pour accompagner les Bureaux d’Études Techniques (BET) pendant les phases de conception, en automatisant à la fois les tâches d’analyse et la production des livrables techniques. Fondée en 2025, Temelion collabore déjà en phase bêta avec plusieurs grands cabinets d’ingénierie et d’architecture en France, et ambitionne de s’étendre prochainement à l’échelle européenne. Pour en savoir plus : www.temelion.ai À propos de 360 Capital 360 Capital est une société de capital-risque early stage – pre-seed à la série B- qui investit en Europe dans les solutions Deep Tech, Climate Tech et Digital-First. Depuis 1997, elle accompagne des entrepreneurs talentueux dans la création d'entreprises technologiques à forte croissance. Dirigée par une équipe expérimentée basée à Paris, à Londres et à Milan, 360 Capital gère 500 millions d'euros d’actifs et un portefeuille de plus de 60 participations. Pour en savoir plus : www.360cap.vc À propos d'ISAI Build Venture Créé en partenariat avec Bouygues, ISAI Build Venture est un fonds d’investissement international qui intervient en tant que co-investisseur dans des levées de fonds allant du seed à la série C, pour des startups développant des solutions accélérant la transformation et la décarbonation des secteurs de la construction, de l’immobilier, des infrastructures de mobilité et de l’énergie. ISAI Build Venture est une stratégie d’investissement opérée par ISAI Gestion (« ISAI »), l’un des pionniers du capital-risque en France, fondé en 2009. L’entreprise est signataire des Principes pour l’Investissement Responsable des Nations Unies (UNPRI) et s’engage activement pour une technologie plus inclusive et à faible empreinte carbone. Pour en savoir plus : www.isai.fr À propos de SE Ventures SE Ventures est une société de capital-risque de 1 milliard d’euros basée à Menlo Park. Composée d’une équipe d’investisseurs et d’opérateurs spécialisés, SE Ventures soutient des entrepreneurs audacieux dans les domaines de l’industrie et des technologies climatiques, et accélère la croissance commerciale des startups de son portefeuille en s’appuyant sur l’expertise sectorielle approfondie et la base mondiale de clients de son investisseur principal, Schneider Electric. Pour en savoir plus : www.seventures.com À propos de Kima Ventures Kima Ventures est le fonds de capital-risque de Xavier Niel, l’un des investisseurs les plus actifs au monde dans les startups en amorçage. Kima investit chaque année dans une centaine de startups, depuis le pré-seed jusqu’au seed. Basée à Station F à Paris, la société a investi depuis 2010 dans près de 1 000 startups, parmi lesquelles Transferwise, Sorare, Agicap, Boom, Ledger ou encore Alma, en apportant aux fondateurs du financement, un réseau stratégique, et un accompagnement personnalisé pour les aider à franchir les prochaines étapes de leur développement.Pour en savoir plus: https://www.kimaventures.com/

ISAI Investments

160 Investments

ISAI has made 160 investments. Their latest investment was in Temelion as part of their Seed VC on September 16, 2025.

ISAI Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

9/16/2025 | Seed VC | Temelion | $3.7M | Yes | 360 Capital Partners, Kima Ventures, SE Ventures, and Undisclosed Angel Investors | 3 |

7/1/2025 | Series A - II | Carbyon | Yes | 3 | ||

4/28/2025 | Seed VC - II | Inicio | $4.55M | No | 3 | |

4/2/2025 | Series B - II | |||||

3/3/2025 | Series B - II |

Date | 9/16/2025 | 7/1/2025 | 4/28/2025 | 4/2/2025 | 3/3/2025 |

|---|---|---|---|---|---|

Round | Seed VC | Series A - II | Seed VC - II | Series B - II | Series B - II |

Company | Temelion | Carbyon | Inicio | ||

Amount | $3.7M | $4.55M | |||

New? | Yes | Yes | No | ||

Co-Investors | 360 Capital Partners, Kima Ventures, SE Ventures, and Undisclosed Angel Investors | ||||

Sources | 3 | 3 | 3 |

ISAI Portfolio Exits

30 Portfolio Exits

ISAI has 30 portfolio exits. Their latest portfolio exit was Adikteev on September 30, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

9/30/2025 | Management Buyout | AgilaCapital | 2 | ||

5/21/2025 | Acquired | 2 | |||

4/29/2025 | Acquired | 5 | |||

Date | 9/30/2025 | 5/21/2025 | 4/29/2025 | ||

|---|---|---|---|---|---|

Exit | Management Buyout | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | AgilaCapital | ||||

Sources | 2 | 2 | 5 |

ISAI Acquisitions

3 Acquisitions

ISAI acquired 3 companies. Their latest acquisition was One Prepaid on July 10, 2025.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

7/10/2025 | One Prepaid | Management Buyout | 3 | |||

6/19/2023 | Other | |||||

3/11/2019 |

Date | 7/10/2025 | 6/19/2023 | 3/11/2019 |

|---|---|---|---|

Investment Stage | Other | ||

Companies | One Prepaid | ||

Valuation | |||

Total Funding | |||

Note | Management Buyout | ||

Sources | 3 |

ISAI Fund History

11 Fund Histories

ISAI has 11 funds, including ISAI Expansion III.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

1/10/2024 | ISAI Expansion III | $311.25M | 2 | ||

4/27/2023 | Isai Build Venture Investment Fund | 1 | |||

12/17/2020 | Isai Venture III | $146.99M | 2 | ||

7/4/2018 | Expansion Fund II | ||||

12/4/2015 | Isai Venture II |

Closing Date | 1/10/2024 | 4/27/2023 | 12/17/2020 | 7/4/2018 | 12/4/2015 |

|---|---|---|---|---|---|

Fund | ISAI Expansion III | Isai Build Venture Investment Fund | Isai Venture III | Expansion Fund II | Isai Venture II |

Fund Type | |||||

Status | |||||

Amount | $311.25M | $146.99M | |||

Sources | 2 | 1 | 2 |

Loading...