Powerful AI-driven discovery, research and insight tools

Personal AI-powered insights on any web page

Instant insights, in the moment

Unique insight and data, plus the creativity of generative AI

Data and insight on 10M+ companies

Data and insight on 1,500+ markets

Like a team of researchers working 24/7 — just for you

National science-backed data science on private companies

Concise, precise visual research that drives decisions

Double-verified, continually refreshed

Market intelligence accessible to AI and agents in real time

Insights that live where you works

Append or add CB Insights data right into Salesforce

Rare data, real edge, right now

Make your AI smarter with our data and tools

A deep dive into tech M&A and IPO trends, covering top investors and VCs, largest exits, and much more.

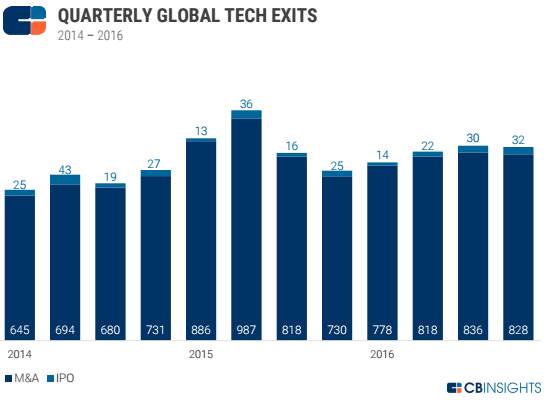

Globally, there were 3260 M&A exits and 98 IPOs in 2016. Total tech exits saw a 4% decline over 2015, which saw 3421 M&A exits and 90 IPOs. Overall, exit activity was up in the second half of 2016 with 1726 exits compared to 1632 exits in the first half of 2016.

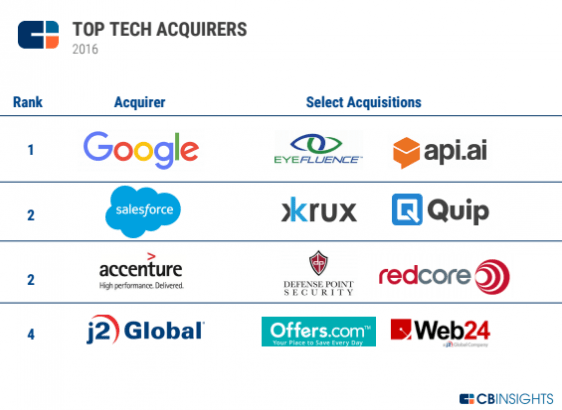

Google made several tech acquisitions in 2016 including Eyefluence and API.AI, among several others. Salesforce and Accenture tied for the number 2 spot followed by J2 Global, which bought companies including Offers.com and Web24.

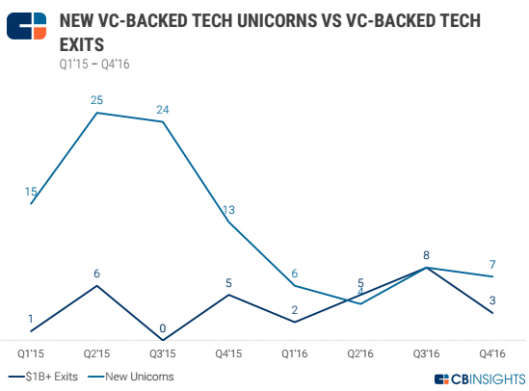

There were 18 $1B+ tech exits in 2016 including The Dollar Shave Club, Cruise Automation, and Jet, among several others. That’s up over 2015 which saw just 12 tech exits of $1B+. However, unicorn births have significantly declined in 2016 with just 25 companies gaining $1B+ valuations, a 68% decline year-over-year compared to 2015.